Loading

Get Form 540 2ez 2007 2008 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 540 2ez 2007 2008 2009 online

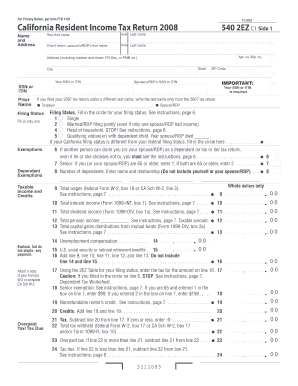

Filling out the Form 540 2ez for the years 2007, 2008, and 2009 can be a straightforward process when approached step by step. This guide offers a comprehensive walkthrough for users of all experience levels to accurately complete the form online.

Follow the steps to complete your Form 540 2ez online.

- Click the ‘Get Form’ button to access the form and open it in your selected editing platform.

- Enter your personal information in the designated fields. This includes your first name, middle initial, last name, address, city, state, zip code, and your social security number (SSN) or individual taxpayer identification number (ITIN). If applicable, include your spouse’s or registered domestic partner’s information.

- Select your filing status by filling in the circle corresponding to your current situation: single, married/RDP filing jointly, head of household, or qualifying widow(er).

- Declare any exemptions. Indicate if someone can claim you as a dependent, and if you or your spouse/RDP are age 65 or older, mark the appropriate box for the senior exemption.

- List any dependents you are claiming. Enter their names and relationship to you, ensuring not to include yourself or your spouse/RDP.

- Enter your total wages as reported on your W-2 forms. This is found in the federal form W-2, box 16 or California schedule W-2, line 3.

- Complete the income section with any additional incomes such as interest, dividends, pension, and capital gains. Refer to the forms 1099 for accurate reporting.

- Calculate your total income by adding the figures from the previous lines as instructed. Then apply the 2EZ Table to determine your tax based on this total.

- If applicable, deduct any credits from your calculated tax amount. Credits could include the senior exemption and nonrefundable renter’s credit.

- Determine whether you owe additional tax or if you have an overpayment by subtracting your credits from the tax you owe. Carefully follow any additional instructions provided.

- If you are expecting a refund, provide your banking details for direct deposit. Ensure that the routing and account numbers are accurate.

- Sign the form to declare that all provided information is true and complete to the best of your knowledge. If filing jointly, both you and your spouse/RDP must sign.

- Save your changes before proceeding to download, print, or share your completed form.

Start filling out your Form 540 2ez online today for a smooth and efficient tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

California Form 540 2EZ is a simplified tax return for state residents. This form is designed for individuals with straightforward tax situations, allowing you to report income and claim deductions easily. If you’re filing for the years 2007, 2008, or 2009, uslegalforms can help you navigate through the details effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.