Loading

Get St 3t

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 3t online

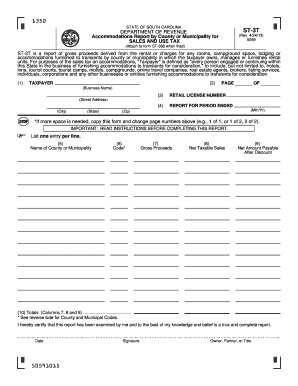

Filling out the St 3t form accurately is essential for reporting gross proceeds from accommodations sales in South Carolina. This guide provides step-by-step instructions to help you complete the form easily and correctly online.

Follow the steps to fill out the St 3t form online.

- Press the ‘Get Form’ button to access the St 3t document online.

- Begin by entering your business name and complete mailing address in Item 1. Ensure that the information is typed or legibly printed.

- For Item 2, input the correct page number based on how many pages of the St 3t you are submitting, such as 1 of 1 or 1 of 2.

- In Item 3, provide the complete retail license number as it appears on form ST-388.

- Enter the reporting period's month and year in Item 4, consistent with the information on form ST-388.

- In Item 5, specify the name of the county or municipality where the rental unit(s) are located.

- Input the municipal or county location code in Item 6 according to the list provided on the back of the form.

- Report the gross proceeds of sales in Item 7 for each county or municipality. Ensure that the total aligns with Line 1B Column C from form ST-388.

- Calculate net taxable sales for each county or municipality in Item 8 by subtracting non-taxable sales from gross proceeds.

- In Item 9, multiply the net taxable sales by two percent to determine the tax, then apply the discount rate from line 5 of form ST-388.

- For Item 10, subtract the discount from the calculated tax to find the net amount payable for each listed county or municipality.

- Finally, sum the totals from Columns 7, 8, and 9 in Item 11 to ensure they match the respective lines on form ST-388. Remember to attach the St 3t to the ST-388 when submitting.

Complete your St 3t form online today to ensure timely and accurate reporting.

Robo 3T and Studio 3T serve similar purposes but cater to different user needs. Robo 3T offers a lightweight tool for basic database management. In contrast, Studio 3T provides advanced features for complex database interactions. Depending on your requirements, either tool can enhance your experience with St 3t effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.