Loading

Get Nc Br Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nc Br Form online

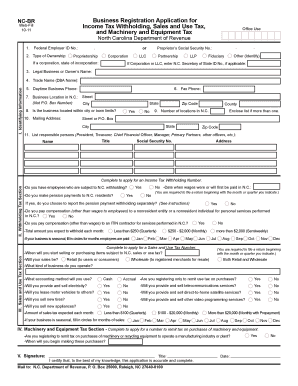

This guide provides essential information on successfully completing the Nc Br Form, which is necessary for business registration, including income tax withholding, sales and use tax, and machinery and equipment tax. By following these clear, step-by-step instructions, users can navigate the form with confidence.

Follow the steps to complete the Nc Br Form online.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- Complete Section I, Identifying Information. Enter your Federal Employer Identification Number or, if not received, indicate that you have applied for it. For sole proprietorships, input the owner's Social Security Number. If applicable, provide the legal name of the corporation or LLC as documented.

- In the appropriate fields, provide the trade name (DBA Name), daytime business phone number, and fax number.

- Fill in the business location details in North Carolina, including the street address (not a P.O. Box), city, state, zip code, and county. Indicate whether the business is within city or town limits.

- List the responsible persons associated with the business, including their names, titles, addresses, and Social Security Numbers.

- If applying for an Income Tax Withholding Number, complete Section II by answering questions regarding employee compensation and expected withholding amounts.

- For a Sales and Use Tax Number, complete Section III by providing information on when sales or purchases subject to N.C. tax will commence.

- If applicable, fill out Section IV to register for the Machinery and Equipment Tax, indicating your plans to purchase machinery.

- Sign the application, ensuring it is signed by an authorized person such as the owner or a corporate officer.

- Mail the completed form to the provided address of the North Carolina Department of Revenue. You can also consider saving changes, downloading, or printing a copy of the form for your records.

Complete your Nc Br Form online today to ensure your business is properly registered.

Yes, if your business operates in North Carolina or has a tax liability, you are required to file a NC return. Filing a return helps ensure compliance with state tax laws and provides an overview of your financial activities. Make sure you complete the NC BR Form to smoothly manage your tax responsibilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.