Get Form Us Company 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Us Company 2002 online

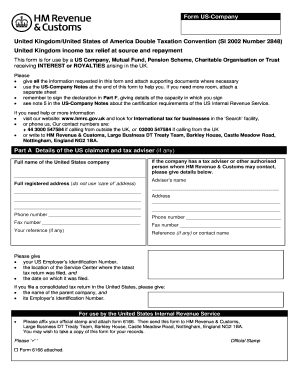

The Form Us Company 2002 is essential for US entities claiming tax relief related to interest or royalties received from the UK. This guide provides a clear and concise approach to completing the form online, ensuring you provide all necessary information.

Follow the steps to effectively complete the Form Us Company 2002 online.

- Press the ‘Get Form’ button to access the form and open it in your browser.

- Complete Part A by providing the full name and registered address of the US company, as well as contact details including phone and fax numbers. If you have a tax adviser, include their information as well.

- In Part B, answer questions in B1 regarding the nature of the claim and whether the claimant is a body corporate.

- Depending on your answers in Part B1, proceed to the appropriate section (B2, B3, B4, B5, or B6) relevant to your entity type.

- In Part C, apply for relief at source by selecting the appropriate category: interest from loans, interest from UK securities, or royalties. Provide all required details, including copies of agreements where needed.

- If claiming for repayment in Part D, complete the relevant information about the income received and the UK tax deducted.

- For Part E, indicate where the payment should be directed for any repayments — to your company directly or a designated bank.

- Finally, complete Part F by signing the declaration to certify that the given information is accurate and complete, and provide your name and status.

Get started with your Form Us Company 2002 and complete your documents online.

The limitation of benefits in the US-UK double tax treaty is a set of rules that prevent individuals and entities from abusing the treaty's provisions for tax advantages. It ensures that only eligible residents can benefit from reduced tax rates or exemptions. Therefore, if you are planning to Form Us Company 2002, being aware of these limitations will be crucial for compliance. You can find more detailed insights and forms on the US Legal Forms website.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.