Loading

Get Form 1020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1020 online

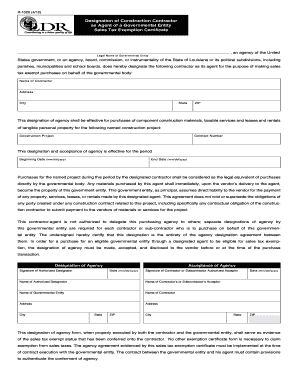

Filling out the Form 1020 online can streamline the process of designating a construction contractor as an agent for sales tax exemption. This guide provides clear and detailed instructions to help you complete the form accurately.

Follow the steps to fill out the Form 1020 efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the legal name of the governmental entity in the designated field at the top of the form.

- Provide the name and address of the contractor being designated as the agent, including city, state, and ZIP code.

- Detail the specific construction project for which the sales tax exemption is being requested by entering the project name and corresponding contract number.

- Indicate the effective period of the designation by filling in the beginning and end dates in the specified formats (mm/dd/yyyy).

- Obtain signatures from the authorized designator of the governmental entity and the contractor or subcontractor accepting the agency. Include the date of signing.

- Review all entered information for accuracy and completeness before finalizing the form.

- Once completed, save any changes made, and utilize options to download, print, or share the form as needed.

Start completing your Form 1020 online today for a smooth and efficient process.

Common withholding mistakes include incorrect filing status, failing to account for additional income, and not considering changes in personal circumstances like marriage or a new job. It's essential to regularly review your tax situation to ensure you withhold the right amount. Avoid errors by using a reliable source such as US Legal Forms, which can provide accurate guidance on filling out Form 1020.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.