Get Pps Profit Share Withdrawal Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pps Profit Share Withdrawal Form online

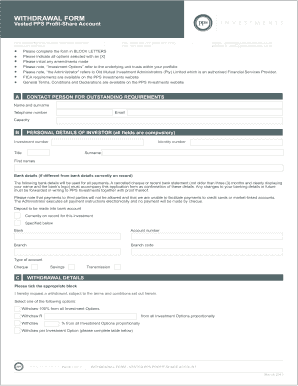

Completing the Pps Profit Share Withdrawal Form online can streamline your withdrawal process and ensure that your information is processed efficiently. This guide will walk you through each section of the form, providing clear instructions to facilitate completion.

Follow the steps to successfully complete the withdrawal form online.

- Click ‘Get Form’ button to access the withdrawal form and open it in your editing tool.

- In section A, provide the contact details for a person who may be contacted regarding any outstanding requirements. Enter their name, surname, telephone number, email address, and capacity.

- Proceed to section B for personal details of the investor. All fields are mandatory. Fill in your investment number, identity number, title, surname, and first names.

- Input your banking details if they differ from those currently on record. Attach a canceled cheque or a recent bank statement, not older than three months, that clearly displays your name and the bank's logo.

- In section C, indicate your withdrawal details by selecting the appropriate option for your withdrawal request. You may choose to withdraw 100% of your investment, a specific amount, or a percentage from all investment options. Complete the table provided with the details of the investment options if applicable.

- Review section D where you can find important terms and conditions regarding your withdrawals. Acknowledge your understanding of these terms.

- Finally, sign and date the form to confirm that all information provided is accurate and complete. Ensure that you retain a copy of the completed form for your records.

- Once completed, you can save the changes, download, print, or share the form as needed for submission.

Start filling out your Pps Profit Share Withdrawal Form online today for a seamless withdrawal experience.

Related links form

Filling out a withdrawal form is a straightforward process. You will need to provide personal information, account details, and the amount you wish to withdraw. Make sure to complete the Pps Profit Share Withdrawal Form carefully and check for accuracy to prevent potential issues with your transaction.

Fill Pps Profit Share Withdrawal Form

This form is to be used for withdrawals from your Investment Account, Endowment Plan, Vested Profit Share Account and Tax Free Investment. First payment to be made on the 28th of. Members can start to take withdrawals 10 years after the Profit-Share Plan commenced. You will need to fill out the Retirement Funds Withdrawal Form from PPS. PPS SHORT-TERM. INSURANCE. Members can start to take withdrawals 10 years after the Profit-Share Plan commenced. Form TSP-75 for age-based withdrawal; Form TSP-76 for financial hardship withdrawal. It is authorised to do so as a manager in terms of the Collective Investment Schemes Control. Act. In this form it is referred to as PSG Asset Management. The PPS Profit-Share Cross-Holdings Booster is awarded over and above the existing allocation and is based on how many qualifying products.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.