Loading

Get Form 575 T 2017 18

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 575 T 2017 18 online

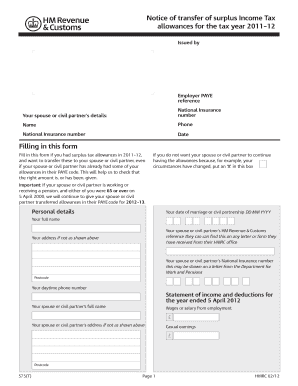

This guide provides a clear and supportive approach to completing Form 575 T 2017 18 online. By following these instructions, users can efficiently transfer surplus tax allowances to their partner.

Follow the steps to complete Form 575 T 2017 18 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in personal details. Provide your full name, date of marriage or civil partnership, and your National Insurance number. If your address is different than previously indicated, provide the updated address information.

- Input your partner's details. Include their full name, National Insurance number, address, and phone number.

- Complete the statement of income and deductions. Enter the income from wages, casual earnings, and any taxable income your partner may have received in the year ended 5 April 2012.

- Record any deductions claimed for the year on the form. Enter the amounts under the appropriate sections, ensuring that all information is accurate.

- Indicate the claim for allowances by ticking the boxes corresponding to the allowances you wish to transfer to your partner. Ensure that you qualify based on the criteria mentioned.

- Complete the declaration section by signing and dating the form to confirm the information provided is correct and complete.

- After filling out the form, you can save changes, download, print, or share it as needed.

Complete your Form 575 T 2017 18 online today for a smooth following process.

In the UK for the tax year 2017, the basic income tax rate is 20% for earnings up to a certain threshold. As your income increases, higher rates apply. Understanding these rates can help you navigate tax forms, including Form 575 T 2017 18, to optimize your financial situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.