Get Professional Tax Registration Form 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Professional Tax Registration Form 1 online

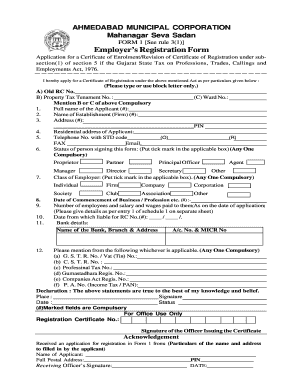

Filling out the Professional Tax Registration Form 1 online can seem overwhelming, but this guide will help you navigate through each section with ease. By following these steps, you will ensure that your application for a Certificate of Registration is completed accurately and efficiently.

Follow the steps to successfully complete the Professional Tax Registration Form 1.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the Old RC No. and either the Property Tax Tenament No. or Ward No., as one of these fields is compulsory.

- Provide the full name of the applicant, as well as the name of the establishment or firm. Ensure you use block letters.

- Enter the complete address of the establishment along with the postal PIN code.

- Fill in the residential address of the applicant and also provide contact information, including telephone numbers (office and residence) and email address.

- Indicate the status of the person signing the form by placing a tick mark in the applicable box. Options include Proprietor, Partner, Principal Officer, Agent, Manager, Director, Secretary, or Other.

- Select the class of employer by ticking one of the options: Individual, Firm, Company, Corporation, Society, Club, Association, or Other.

- Enter the date of commencement of business or profession and specify the number of employees along with the corresponding salaries and wages. A detailed breakdown may need to be provided on a separate sheet.

- Provide your bank details, including the bank's name, branch, address, account number, and MICR number.

- Select one from the options provided that applies to you: GSTR No., CST No., Professional Tax No., Gumastadhara Registration No., Companies Act Registration No., or PAN.

- Review your information, ensuring that all compulsory fields, marked with (#), are completed accurately.

- Sign the declaration stating that the statements are true to the best of your knowledge and belief, then date the application.

- After completing the form, ensure to save your changes. You can also download, print, or share the completed form as needed.

Complete your Professional Tax Registration Form 1 online today to ensure compliance and avoid penalties.

Form DE 1 is the registration form used in California for employers to report payroll taxes. It is essential for establishing your business with the Employment Development Department. Completing this form helps ensure that legal tax payments are made on behalf of employees. If you're already familiar with the Professional Tax Registration Form 1, you'll find the DE 1 to follow a similar process for tax compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.