Get Guarantor Form For Loan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Guarantor Form For Loan online

Completing the Guarantor Form For Loan online requires careful attention to detail and accurate information. This guide will walk you through each section of the form to ensure a smooth submission process.

Follow the steps to successfully complete your form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

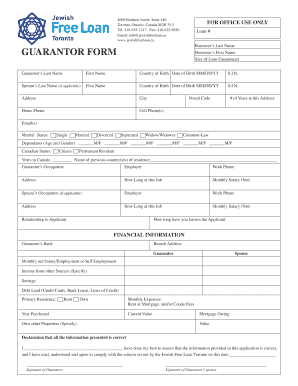

- Begin by filling out the borrower's information. Enter the last and first name of the borrower along with the size of the loan that is being guaranteed.

- Next, input your personal information as the guarantor. This includes your last and first name, country of birth, date of birth in MM/DD/YY format, and your Social Insurance Number (S.I.N.).

- If applicable, provide your spouse's information, including their last and first name, country of birth, date of birth in MM/DD/YY format, and their S.I.N.

- Fill in your current address, including city and postal code. Include your home phone number, cell phone number(s), and email addresses.

- Choose your marital status from the options provided: single, married, divorced, separated, widow/widower, or common-law. If you have dependents, list their ages and genders.

- Indicate your Canadian status as either a citizen or a permanent resident. Additionally, provide the number of years you have lived in Canada and the names of any previous countries of residence.

- Provide details regarding your employment. Please include your occupation, employer's name, work phone number, work address, duration at the job, and your monthly net salary.

- If applicable, fill in your spouse's occupation and the same employment details as you provided for yourself.

- Describe your relationship to the applicant and how long you have known them.

- In the financial information section, include the name of your bank and branch address. Provide your monthly net salary, any income from other sources, savings, and details of your debt load.

- Specify your residence status (rent or own) and fill in the year it was purchased. If you own other properties, specify those as well.

- Outline your monthly expenses, including rent or mortgage, condo fees, current value of the property, mortgage owing, and other relevant financial information.

- Review the declaration statement and confirm that all provided information is accurate. Sign as the guarantor and, if applicable, have your spouse sign as well.

- After completing all sections, save your changes, download a copy for your records, print the form, or share it as required.

Start completing your Guarantor Form For Loan online now to ensure a hassle-free process.

An example of a guarantor could be a parent who agrees to guarantee a loan for their child who is purchasing their first home. In this case, the parent fills out the guarantor form for the loan, providing their financial details to assure the lender. This setup can enhance the borrower’s chances of approval by showing that someone trustworthy stands behind the loan. Accessing resources on uslegalforms can help clarify any further examples you might need.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.