Loading

Get Stamp Duty Refund Form Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Stamp Duty Refund Form Pdf online

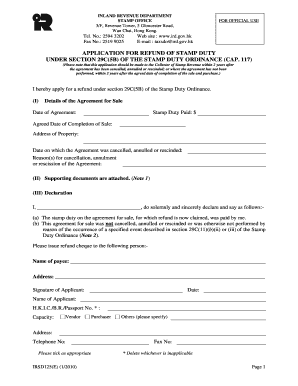

Filling out the Stamp Duty Refund Form Pdf online is a straightforward process that can help you claim back stamp duty that you are entitled to. This guide will walk you through each section of the form, ensuring that you complete it accurately and efficiently.

Follow the steps to successfully complete the form online:

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Provide the details of the Agreement for Sale: Enter the 'Date of Agreement,' the 'Stamp Duty Paid,' and the 'Agreed Date of Completion of Sale.' Additionally, fill in the 'Address of Property' and the 'Date on which the Agreement was cancelled, annulled or rescinded.'

- List the 'Reason(s) for cancellation, annulment or rescission of the Agreement' in the provided space.

- Indicate in section (II) whether the required supporting documents are attached.

- In section (III), you must complete the declaration. Start with stating your name and affirming that the stamp duty was paid by you. Confirm whether the agreement was not cancelled, annulled, or rescinded due to specific conditions.

- Provide the name of the payee who should receive the refund cheque and their 'Address.'

- Sign the form, entering your 'Date,' full 'Name,' identification number (H.K.I.C./B.R./Passport No.), and specify your 'Capacity' as either Vendor, Purchaser, or Others.

- Fill in your contact details, including 'Address,' 'Telephone No,' and 'Fax No.' Ensure that you tick the appropriate options as needed.

- Once all fields are completed, you have options to save the changes, download, print, or share the form.

Take the first step towards claiming your refund by completing the Stamp Duty Refund Form online.

Yes, a solicitor can assist you with various aspects of stamp duty, including filing refund applications. They can guide you through the paperwork, ensuring that you complete the Stamp Duty Refund Form PDF accurately. With their expertise, you can navigate the complexities of the stamp duty process with confidence and efficiency.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.