Loading

Get Ie Form P50

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE Form P50 online

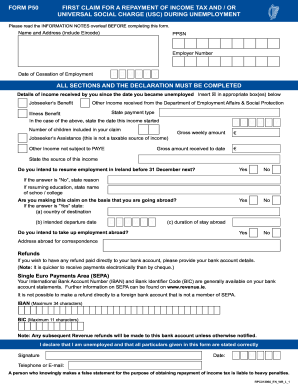

Filling out the IE Form P50 online is a straightforward process that allows individuals who are unemployed to claim a refund of income tax and/or Universal Social Charge (USC). This guide provides step-by-step instructions to assist you in completing the form correctly and efficiently.

Follow the steps to fill out the IE Form P50 online accurately.

- Click ‘Get Form’ button to obtain the form and open it in your editing platform.

- Enter your name and address, including your Eircode, in the designated fields. Ensure that all details are accurate to avoid delays.

- Provide your Personal Public Service Number (PPSN) in the specified section.

- Input your employer number and the date of cessation of employment, presented in the format D D M M Y Y.

- Complete all sections of income received since becoming unemployed by marking ‘T’ in the appropriate boxes for Jobseeker’s Benefit, Illness Benefit, and any other income sources.

- If you received any income, state when it started by filling out the date field (D D M M Y Y).

- Indicate the number of children included in your claim and provide the gross weekly amount in Euros (€).

- Detail the gross amount received to date in Euros (€).

- Answer whether you intend to resume employment in Ireland before the year ends by marking 'Yes' or 'No.' If 'No', state your reason.

- If you are resuming education, provide the name of the school or college.

- If applicable, indicate if you are making this claim based on going abroad, and include the country of destination, intended departure date, and duration of stay.

- Provide your bank account details for any refunds, ensuring to include your International Bank Account Number (IBAN) and Bank Identifier Code (BIC).

- Read the declaration carefully and confirm its accuracy by signing and dating the form (D D M M Y Y).

- Submit the completed form by saving changes, then download, print, or share it as needed.

Complete your IE Form P50 online today to claim your income tax and USC refund efficiently.

The 30 day tax rule in Ireland allows you to claim a tax refund within 30 days of ceasing employment. This means if you have recently stopped working, you can utilize the IE Form P50 to expedite your refund process. Timeliness is key, so ensure you act quickly to maximize your refund potential.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.