Loading

Get Crs Small Business Administration 7(a) Loan Guaranty Program 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CRS Small Business Administration 7(a) Loan Guaranty Program online

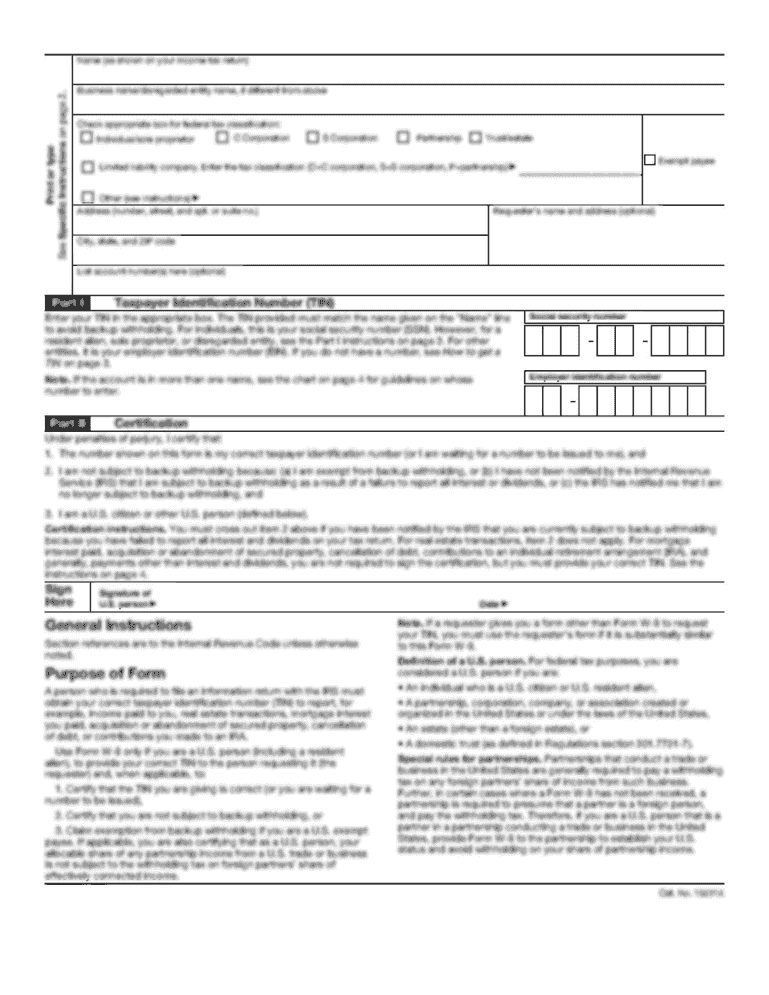

This guide provides a detailed overview of filling out the CRS Small Business Administration 7(a) Loan Guaranty Program form online. It aims to support users through each section of the form, ensuring clarity and confidence in the process.

Follow the steps to complete your application effectively.

- Click the ‘Get Form’ button to access the CRS Small Business Administration 7(a) Loan Guaranty Program form.

- Begin by entering your business information, including your legal name, business address, and contact information. Ensure all details are accurate and match official documents.

- Fill out the loan request section, specifying the amount you are seeking and the intended use of the funds. Clearly describe how the loan will help your business.

- Provide financial information related to your business, including existing debts, annual revenue, and your profit and loss statements for the past few years if available.

- Complete the borrower information form (Form 1919) offering personal details like social security number, business ownership type, and demographics. Be thorough to facilitate processing.

- Attach any required documents such as tax returns, business plans, and proof of collateral. These may be essential to verify your eligibility.

- Review your application for completeness and accuracy. Ensure all sections are filled in, and documents are attached as needed.

- Submit the form electronically for processing. After submission, retain a copy for your records and note the submission confirmation for future reference.

- If necessary, follow any additional prompts or instructions that may arise during the submission process.

Complete your documents online to secure your loan and support your business growth.

The 5 Cs of credit are crucial when applying for the CRS Small Business Administration 7(a) Loan Guaranty Program. They include Character, Capacity, Capital, Collateral, and Conditions. Understanding these elements helps you present yourself as a trustworthy borrower to lenders. Focusing on these factors can significantly increase your chances of loan approval and financial success.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.