Get Ar Lease To Purchase Option Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR Lease To Purchase Option Agreement online

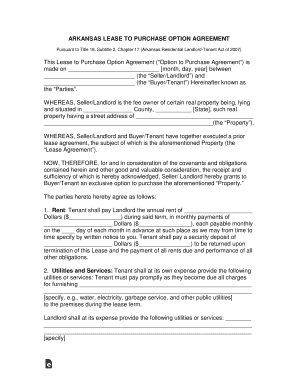

The AR Lease To Purchase Option Agreement is a key document for those looking to transition from renting to owning a property. This guide provides clear and supportive instructions on how to successfully complete the agreement online, ensuring that you understand each component involved.

Follow the steps to fill out the AR Lease To Purchase Option Agreement online

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the date of the agreement in the appropriate field, specifying the month, day, and year.

- Fill in the name of the Seller/Landlord and the Buyer/Tenant in the designated spaces, ensuring accuracy for both parties.

- In the property address section, provide the complete address of the property, including the county and any relevant details.

- Indicate the annual rent amount and specify the monthly payment details, along with the due date for each month's payment.

- List the utilities and services that the Tenant is responsible for, including any specifics like water, electricity, or garbage service.

- Complete the section regarding the security deposit by entering the amount and noting the conditions for its return upon termination.

- Fill out the option term by providing the start and expiration dates for the purchase option, ensuring they are accurate.

- Specify the non-refundable fee for the option to purchase and ensure this is acknowledged by the Seller/Landlord.

- Enter the total purchase price for the property and the amount that will be credited towards the purchase price at closing for timely payments.

- In the exclusivity section, confirm that the option is exclusive and non-assignable, keeping this agreement strictly between the named parties.

- Complete the closing and settlement details, noting any agreed responsibilities for closing costs and documenting the title company.

- Review the financing availability section to understand obligations for obtaining financing without the Seller/Landlord's guarantees.

- Ensure the remedies upon default are clear and understood, specifying any consequences for not adhering to the agreement.

- All parties involved should review and sign where indicated, ensuring they print their names clearly under their signatures.

- Once completed, save your changes, download, print, or share the form as needed.

Complete your documents online today for a smoother lease to purchase experience.

The rules for a capital lease generally include ownership transfer at the end of the term, a bargain purchase option, lease term covering 75% or more of the asset's life, a present value of lease payments exceeding 90% of the asset's fair value, and no cancellation option. Understanding these rules is essential when entering an AR Lease To Purchase Option Agreement. Compliance ensures that you benefit from the advantages of capital leases while maintaining proper accounting practices.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.