Loading

Get Uwmf Declaration Of Tax Status Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UWMF Declaration Of Tax Status Form online

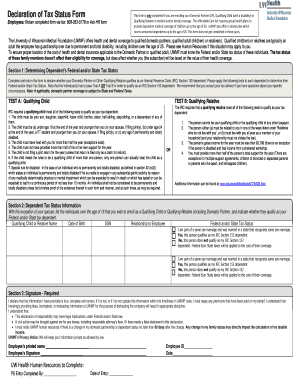

Filling out the UWMF Declaration Of Tax Status Form is essential for employees who want to enroll their domestic partner, qualifying child, or qualifying relative in health and dental coverage. This guide will provide clear instructions on how to complete the form online to ensure accurate tax status declaration.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- In Section 1, determine the federal and/or state tax status of your domestic partner or qualifying relative. Apply the necessary tests — Test A for qualifying children and Test B for qualifying relatives. Refer to the criteria listed in the section to see if they qualify under IRC Section 152.

- For Section 2, list all individuals over the age of 18 whom you wish to enroll as a qualifying child or qualifying relative. Include their names, dates of birth, Social Security numbers, relationships to you, and indicate their federal and/or state tax status.

- In Section 3, provide your printed name and signature, confirming the accuracy of the information provided. Acknowledge the legal implications of false statements and your responsibility to report any changes in your domestic partnership or dependent status.

- After completing the form, ensure you save any changes made. Once satisfied, download or print the form for your records and submit it as instructed, either via fax or through HR.

Complete your UWMF Declaration Of Tax Status Form online to ensure compliance and accurate coverage.

What is a 1040 form? Form 1040, formally known as the “U.S. Individual Income Tax Return,” is the form people use to report income to the IRS, claim tax deductions and credits, and calculate their tax refund or tax bill for the year. The IRS releases a revised version of the form for each tax filing year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.