Loading

Get Sd Form 21 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SD Form 21 online

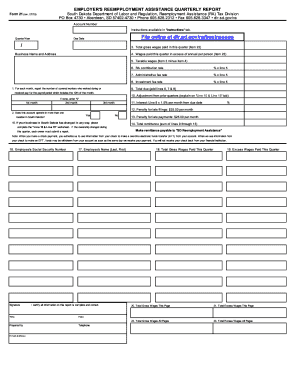

The SD Form 21 is an essential document for employers to report wages paid and contributions due for reemployment assistance in South Dakota. This guide provides clear, step-by-step instructions for filling out the form online, ensuring users can complete it efficiently and accurately.

Follow the steps to accurately complete the SD Form 21 online:

- Press the ‘Get Form’ button to access the form and open it in your preferred document editor.

- Enter your account number at the top of the form to identify your business.

- In the section marked 'Quarter/Year', input the relevant quarter and the two-digit year for which you are reporting.

- Specify the due date for the report, which is typically the last day of the month following the end of the quarter.

- Report the total gross wages paid in this quarter in Item 22. Ensure this amount reflects all wages subject to the Unemployment Insurance Act.

- Indicate any wages paid this quarter that exceed the annual wage base in Item 23.

- Calculate taxable wages by subtracting the excess wages from the total gross wages and enter that amount in Item 3.

- Fill in your current Unemployment Insurance contribution rate in Line 6.

- Complete the section for the number of covered workers for each month of the quarter.

- Enter the relevant rates for administrative fees and investment fees in Lines 7 and 8, respectively.

- Calculate the total due by adding the amounts from lines 9, 10, 11, and any penalties for late filings.

- Review and ensure all entries are accurate, then proceed to save changes, download, print, or share the form as needed.

Complete your SD Form 21 online today to ensure compliance and accurate reporting.

While South Dakota's tax structure is unique, Montana typically reviews its taxable wage base annually. For 2025, you'll need to consult Montana's official announcements for the latest numbers. However, SD Form 21 provides tools that can assist you in understanding the differences across state lines, aiding in more informed business decisions in both states.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.