Loading

Get Canada T5013 Sch 1 E 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T5013 SCH 1 E online

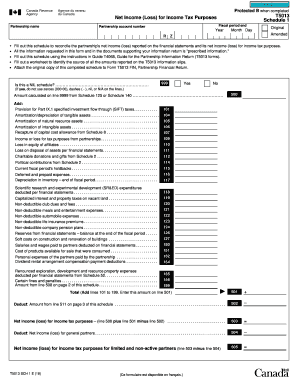

Completing the Canada T5013 SCH 1 E form is essential for accurately reporting a partnership's net income or loss for income tax purposes. This guide provides clear instructions to help users complete the form efficiently and correctly when filing online.

Follow the steps to fill out the Canada T5013 SCH 1 E online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the partnership name, fiscal period end, partnership account number, and the year of the return. This information is critical for identifying the partnership and its tax obligations.

- Complete the section regarding whether this schedule is a NIL schedule. If this is the case, do not use zeroes, dashes, or the term 'N/A' in the lines of the form.

- Accurately calculate the total net income (loss) for income tax purposes based on the figures reported throughout the form, including deductions and other adjustments.

- After completing all necessary fields and ensuring accuracy, you can save changes, download, print, or share the form as needed to finalize the filing.

Complete your Canada T5013 SCH 1 E filing online today for accurate tax reporting.

To obtain a proof of income statement, you can request it from your employer, who may issue a T4 slip detailing your earnings. Alternatively, if you are a self-employed individual, you can prepare and issue invoices or statements that showcase your income. Utilizing US Legal Forms, you can find templates and guides for creating your proof of income documentation accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.