Loading

Get Hsbc Inter-governmental Agreement Declaration To Confirm Your Tax Status Under Fatca 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

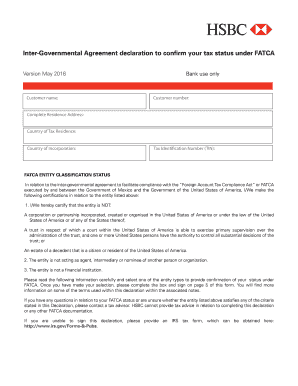

How to fill out the HSBC Inter-Governmental Agreement Declaration To Confirm Your Tax Status Under FATCA online

This guide provides a step-by-step approach to completing the HSBC Inter-Governmental Agreement Declaration to confirm your tax status under FATCA online. It aims to assist users in accurately filling out the necessary fields and ensuring compliance.

Follow the steps to complete your declaration online.

- Click ‘Get Form’ button to access the declaration form and open it for editing.

- Enter your customer name in the designated field at the top of the form.

- Provide your customer number in the field labeled 'Customer number.'

- Fill in your complete residence address, ensuring all sections are accurately filled out.

- Indicate your country of tax residence in the specified section.

- Complete the 'Country of incorporation' field if applicable.

- Enter your Tax Identification Number (TIN) in the corresponding field.

- Select the appropriate FATCA entity classification status by following the provided guidance in the form.

- If relevant, provide details for the 'Controlling Persons' section, including names, addresses, and TINs.

- Ensure all information is correct, and proceed to sign the declaration as required on the last page of the form.

- After signing, you can save changes, download, print, or share the completed form as needed.

Complete your HSBC Inter-Governmental Agreement Declaration online today.

Generally, U.S. persons, including citizens and green card holders, as well as some foreign entities, must complete FATCA forms. If you hold foreign financial accounts, you may also need to participate in the HSBC Inter-Governmental Agreement Declaration To Confirm Your Tax Status Under FATCA. Understanding your obligations is crucial for maintaining compliance and avoiding penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.