Get Usda Refinance Fact Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the USDA refinance fact sheet online

Filling out the USDA refinance fact sheet online is a straightforward process designed to assist users in refinancing their USDA guaranteed loans. This guide offers step-by-step instructions to ensure a smooth and efficient completion of the form.

Follow the steps to successfully complete the USDA refinance fact sheet online.

- Press the ‘Get Form’ button to obtain the USDA refinance fact sheet and open it in your preferred online editor.

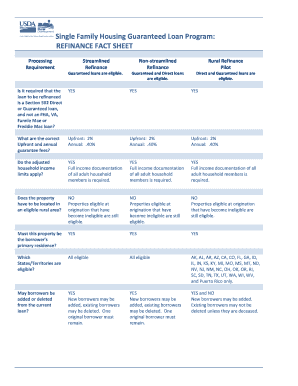

- Review the eligibility requirements outlined in the fact sheet. Ensure your current loan is a Section 502 Direct or Guaranteed loan and is not backed by FHA, VA, Fannie Mae, or Freddie Mac.

- Input your upfront and annual guarantee fees, both of which are stated as 2% upfront and 0.40% annually.

- Document your adjusted household income. Be prepared to provide full income documentation for all adult members of your household.

- Specify the property details, confirming whether it is located in an eligible rural area and is your primary residence.

- Indicate if any new borrowers will be added or if any existing borrowers will be deleted from the current loan.

- Complete any additional questions regarding credit reports, loan amounts, and allowed cash-out scenarios.

- Review the terms, including interest rates, loan term options, and ratios required for approval.

- Finalize your form by checking all entered information for accuracy. Once verified, save changes, download, print, or share the completed form as needed.

Begin filling out your USDA refinance fact sheet online today to take advantage of this valuable refinancing opportunity.

USDA Streamline Assist is a specialized program that simplifies the refinancing process for existing USDA loans. This program allows qualified borrowers to refinance without providing extensive documentation, making it faster and more accessible. The USDA Refinance Fact Sheet includes comprehensive details about this program, enabling you to explore whether you qualify for these streamlined benefits. By utilizing this feature, you can potentially lower your monthly payments and improve your mortgage terms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.