Loading

Get Hvhc Request For Irs Form W-2 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HVHC Request For IRS Form W-2 online

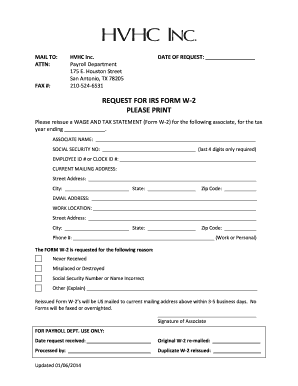

In this guide, we will provide a step-by-step approach to completing the HVHC Request For IRS Form W-2 online. This form allows associates to request a reissue of their Wage and Tax Statement (Form W-2) for various reasons.

Follow the steps to successfully complete the HVHC Request For IRS Form W-2

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the date of your request in the designated field. This is essential for tracking your request.

- Complete the 'Associate Name' section with your full name as it appears on official documents.

- Provide the last four digits of your Social Security Number in the specified field.

- Fill in your Employee ID or Clock ID number, as applicable, to ensure proper identification.

- Input your current mailing address, including street, city, state, and zip code. This is where your reissued W-2 will be sent.

- Enter your email address for any electronic correspondence regarding your request.

- Specify your work location by entering the street address, city, state, and zip code.

- Provide a phone number, which can be either a work or personal number, for any follow-up communication.

- Select the reason for requesting the reissued Form W-2 from the provided options, or specify a different reason if necessary.

- Sign the form to validate your request, ensuring it is completed authentically.

- After reviewing all entries for accuracy, save any changes, and prepare to download, print, or share the completed form, if necessary.

Complete your HVHC Request For IRS Form W-2 online today for a quick and efficient process.

Filling out a W-2 form requires accurate information about your earnings and tax withholdings. Ensure you enter your personal details, including your name, Social Security number, and the employer's information correctly. It's essential to follow the instructions on the form closely; using the HVHC Request For IRS Form W-2 can guide you through this process smoothly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.