Loading

Get Mastering Depreciation Final Examination

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mastering Depreciation Final Examination online

Completing the Mastering Depreciation Final Examination is a crucial step in demonstrating your knowledge of depreciation. This guide provides a straightforward approach to filling out the exam efficiently and accurately.

Follow the steps to complete your examination successfully.

- Click the ‘Get Form’ button to retrieve the Mastering Depreciation Final Examination. This action allows you to open the examination document online.

- Detach the Final Examination Answer Sheet provided within the document. This step is essential before proceeding with your answers.

- Read each multiple-choice question carefully. Each question will require you to select the correct answer by marking the corresponding box on the Answer Sheet.

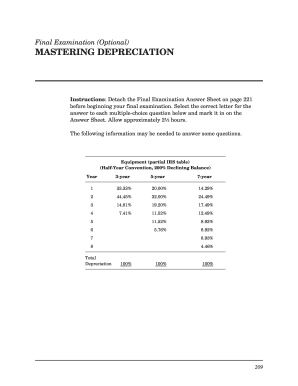

- Utilize any reference materials or charts included in the examination, such as IRS depreciation tables, to assist in answering the questions accurately.

- After completing all questions, review your selections to ensure all answers are marked correctly.

- Save your completed Answer Sheet. You may choose to download, print, or share it as needed.

- Return the Answer Sheet to the specified address for grading. This is typically noted within the instructions of the examination.

Prepare and complete your Mastering Depreciation Final Examination online today!

In final accounts, treat depreciation as a necessary expense that decreases net income and adjusts asset values. Proper treatment ensures compliance with accounting principles and provides a realistic overview of asset performance. Understanding these nuances is essential for anyone preparing for the mastering depreciation final examination.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.