Get Authorization Agreement For Preauthorized Payments Form - Cms.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Authorization Agreement For Preauthorized Payments Form - CMS.gov online

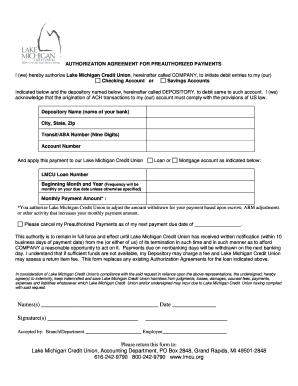

Filling out the Authorization Agreement For Preauthorized Payments Form - CMS.gov online can streamline your payment process with Lake Michigan Credit Union. This guide will provide step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the form online

- To begin, locate the form by selecting the ‘Get Form’ button to access and open the document in your online editor.

- Fill in the depository name, which is your bank's name, along with the city, state, and zip code.

- Enter the Transit/ABA number, which is a nine-digit identifier for your bank.

- Provide your account number associated with your checking or savings account.

- Indicate whether the payment is for a loan or mortgage by filling in the appropriate section.

- If applicable, input the Lake Michigan Credit Union Loan number, so the payment can be properly allocated.

- Specify the beginning month and year when the payments will start, noting that the frequency is set to monthly on your due date unless stated otherwise.

- Fill in the monthly payment amount. Remember that you permit Lake Michigan Credit Union to modify this amount based on any escrow adjustments or other changes.

- If you wish to cancel preauthorized payments, clearly state the next payment due date for cancellation.

- Sign the form to authorize the agreement, and provide the date of signing.

- Finally, review your entries, save your updates, and then download, print, or share the completed form as needed.

Complete your Authorization Agreement For Preauthorized Payments Form online today to ensure seamless transactions.

Related links form

The Authorization Agreement For Preauthorized Payments Form - CMS, commonly referred to as form 5510, is essential for authorizing direct payments. Users complete this form to set up automatic withdrawals from their bank accounts for recurring payments. This process simplifies financial management by ensuring timely payments without manual intervention. Ultimately, it enables individuals and organizations to maintain their financial commitments effortlessly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.