Loading

Get Lump Sum Promissory Note

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lump Sum Promissory Note online

Filling out the Lump Sum Promissory Note online is a straightforward process that allows borrowers to formalize their loan agreement. This guide will walk you through each section of the form, ensuring you understand what information is needed.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to access the template of the Lump Sum Promissory Note. This action will enable you to open the form in an online editor where you can fill out the required fields.

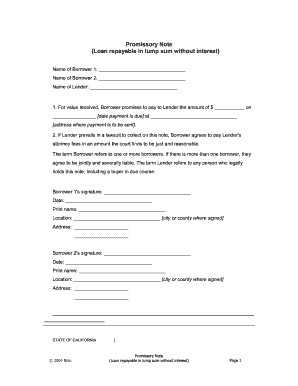

- Enter the names of the borrowers in the designated fields labeled 'Name of Borrower 1' and 'Name of Borrower 2.' If there is only one borrower, fill in the first field and leave the second blank.

- Provide the name of the lender in the 'Name of Lender' field. This is the individual or entity that will receive repayment of the loan.

- In the first section of the document, specify the loan amount in the space provided next to '$' and enter the date when the payment is due. Additionally, include the address where the payment should be sent.

- Review the terms outlined in the document. Note that if the lender has to take legal action to collect the amount, the borrower will be liable for reasonable attorney fees.

- If applicable, both borrowers should provide their signatures, date of signing, printed names, location of signing, and their addresses in the designated sections provided.

- Once all fields are completed accurately, save your changes and consider downloading or printing the completed form for your records. You may also share it with relevant parties.

Start filling out your Lump Sum Promissory Note online today to ensure your loan agreement is properly documented.

An example of a promissory note includes a borrower agreeing to repay $5,000 to a lender within a year, with an interest rate of 5%. This note specifies the repayment schedule and may include consequences for non-payment. Utilizing a Lump Sum Promissory Note allows you to outline specific terms for your agreement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.