Loading

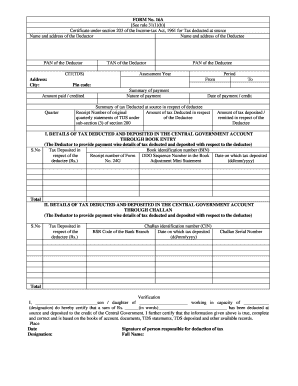

Get Form No 16a See Rule 31 1 B

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form No 16a See Rule 31 1 B online

Filling out Form No 16A is an essential task for individuals and organizations that have deducted tax at source. This guide will provide clear instructions to help you complete the form online with ease.

Follow the steps to fill out Form No 16a online effectively.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred online editor.

- Begin by entering the name and address of the deductor. This should include the complete official name as registered with tax authorities.

- Next, provide the name and address of the deductee, ensuring all details are accurate.

- Input the Permanent Account Number (PAN) for both the deductor and the deductee. This is a crucial identifier for tax purposes.

- Specify the Tax Deduction and Collection Account Number (TAN) of the deductor.

- Indicate the assessment year for which the tax has been deducted.

- Fill in the period of payment with the start and end dates during which the transaction took place.

- Record the amount paid or credited and specify the quarter in which the deduction falls.

- Provide a summary of payment, including the nature of the payment and the date it was made.

- In the section for tax deducted at source, include the receipt number of the original TDS, the amount of tax deducted, and the amount deposited for the deductee.

- Detail any further tax deducted and deposited in the Central Government account, ensuring each entry is complete with reference numbers and amounts.

- Complete the verification section where the responsible individual certifies the details. Ensure to include the designation, full name, place, and date.

- Finally, save your changes, and choose to download, print, or share the completed form as needed.

Complete your tax documentation online efficiently today!

To download your TCS certificate, first, visit the official website of the tax authority or the department handling TCS transactions. You will likely need to log in using your credentials and navigate to the section for tax certificates. Once there, you can select the applicable financial year and download your TCS certificate. In connection with Form No 16A See Rule 31 1 B, understanding TCS can provide you with better insight into your tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.