Get Request For New Pan Card Or / And Changes Or Correction In Pan Data - Taxlawassociates

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Request For New PAN Card Or / And Changes Or Correction In PAN Data - Taxlawassociates online

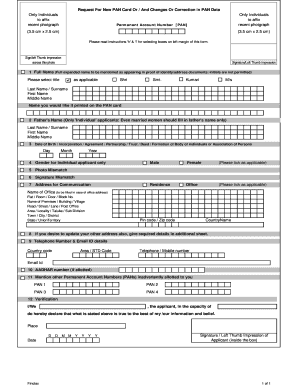

Filling out the Request For New PAN Card Or / And Changes Or Correction In PAN Data form is essential for individuals seeking to obtain a new Permanent Account Number (PAN) card or make updates to their existing PAN details. This guide will provide you with clear, step-by-step instructions to successfully complete the form online.

Follow the steps to fill out the form accurately.

- Click the ‘Get Form’ button to access the form and open it in the editing interface.

- Affix a recent passport-sized photograph of yourself in the designated area on the form, ensuring it measures 3.5 cm x 2.5 cm.

- Enter your full name in the designated fields. Provide your title, last name, first name, and middle name as they appear on your proof of identity or address documents. Avoid using initials.

- For individual applicants, fill in your father’s name in the specified fields, including last name, first name, and middle name.

- Enter your date of birth in the format of day, month, and year.

- Select your gender by ticking the appropriate box for male or female.

- Indicate whether you are providing a residence or office address by ticking the corresponding box.

- Fill in your address for communication, including all relevant fields such as flat number, premises name, street, locality, city, state, and postal code.

- If you wish to update another address, mention the required details on an additional sheet.

- Provide your telephone number and email ID, making sure to include the country code and area code.

- If you have been allocated an Aadhaar number, include it in the appropriate section.

- Mention any other Permanent Account Numbers (PANs) that may have been inadvertently assigned to you.

- Review the verification statement at the end of the form. As the applicant, declare that the information provided is true to the best of your knowledge, sign and date the form.

- Once you have filled out all necessary fields and reviewed the information, you can save changes, download, print, or share the form as needed.

Complete your Request For New PAN Card Or / And Changes Or Correction in PAN Data online to ensure your details are accurate and up to date.

Changing a PAN card correction online is a simple process. Visit the official website and navigate to the correction application section. Fill out the online form with accurate details that require correction, and submit accordingly. Leveraging digital platforms enhances your request for new PAN card or changes or correction in PAN data - Taxlawassociates.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.