Loading

Get Ira4 W4p Laz Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ira4 W4p Laz Fillable Form online

Filling out the Ira4 W4p Laz Fillable Form online can be a straightforward process if you follow the right steps. This guide provides clear instructions to help you navigate each section of the form with confidence.

Follow the steps to complete the form effectively

- Click the ‘Get Form’ button to obtain the form and open it in an editable format.

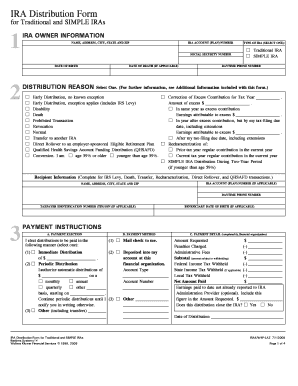

- Enter your personal information in the 'IRA Owner Information' section. Include your name, address, city, state, and ZIP code. You will also need to add your IRA account number, social security number, date of birth, and, if applicable, the date of death.

- Select the appropriate 'Distribution Reason' by checking the relevant box, such as Early Distribution or Normal. This step is crucial as it determines possible tax implications.

- Indicate the 'Type of IRA' by selecting either Traditional IRA or SIMPLE IRA to specify the account type for your distribution.

- Fill in your daytime phone number for contact purposes.

- Complete the 'Recipient Information' section if applicable, particularly for situations like IRS Levy, Death, or Transfer. Include the necessary information such as the recipient's name, address, and taxpayer identification number.

- In the 'Payment Instructions' section, select your payment election and method. Indicate whether you want an immediate distribution, periodic distributions, or other options, and specify any details regarding how you want to receive your payments.

- Review the 'Withholding Election' options. Indicate your preference for federal and state income tax withholding from the distribution.

- Sign and date the form in the 'Signatures' section, certifying that you are the IRA owner or a legally authorized individual. Ensure that all information provided is accurate.

- Once you have filled out all sections, save the changes, and download the completed form. You can also print it or share it as needed.

Complete the Ira4 W4p Laz Fillable Form online today for a hassle-free experience.

If you are a foreign individual or business receiving income from U.S. sources, you will need to fill out a W-8BEN form. This form certifies your foreign status and helps you avoid or reduce U.S. tax withholding. Ensuring you complete the necessary paperwork is essential for compliance and financial planning. The Ira4 W4p Laz Fillable Form can assist you in preparing this form accurately and efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.