Get Combined Excise Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Combined Excise Tax Return online

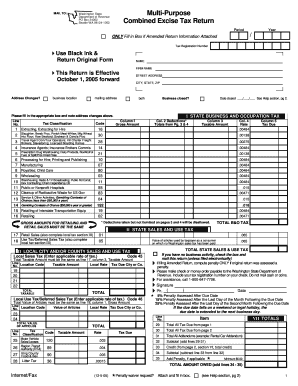

The Combined Excise Tax Return is an essential document for businesses operating in Washington State, enabling them to report their tax obligations efficiently. This guide provides step-by-step instructions to assist users in completing the form online with ease and confidence.

Follow the steps to accurately complete your Combined Excise Tax Return.

- Press the ‘Get Form’ button to access the Combined Excise Tax Return and view it in the editor.

- Fill in your tax registration number in the designated box at the top of the form. This is important for the identification of your business.

- Provide your name, firm name, and address details accurately. Ensure that the mailing address is correct and reflects any current changes.

- Select your tax classification based on your business activities. This includes options like Slaughtering, Manufacturing, or Retailing. Mark the appropriate checkboxes.

- For each applicable category, report your gross amount, deductions, and taxable amounts as specified in the respective columns. Be meticulous to avoid errors.

- Complete the local city and/or county sales and use tax section, entering relevant details and codes for accurate calculations.

- Carefully review the total taxes calculated and ensure that all figures correspond to your business activity reports. Double-check for accuracy.

- If you are filing an amended return, make sure to attach the amended return information as specified.

- Sign the form at the bottom, providing your contact information and the date of submission.

- After finalizing your form, save changes, download a copy for your records, or print the document for mailing.

Complete and submit your Combined Excise Tax Return online today for timely and accurate reporting.

Get form

In Washington state, businesses that sell products or provide services are responsible for paying the excise tax. This tax is collected from the end consumer but is remitted by the business. Whether you operate a large corporation or a small business, understanding your obligations is essential for compliance. You may need to file a Combined Excise Tax Return to accurately report these taxes.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.