Loading

Get Form 6166

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 6166 online

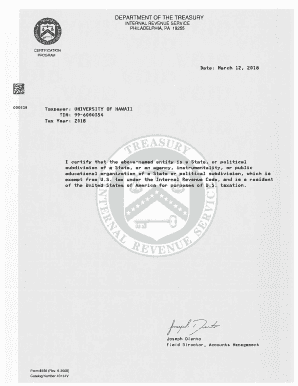

Filling out Form 6166 accurately is essential for entities seeking tax-exempt status confirmation. This form certifies an entity's status as exempt from U.S. taxation and must be completed thoroughly to ensure compliance.

Follow the steps to complete Form 6166 with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Begin by confirming your entity's name. Ensure all information matches the official records to avoid processing delays.

- Enter the Taxpayer Identification Number (TIN). This unique identification is essential for the form to be processed correctly.

- Indicate the corresponding tax year for which the certification is being requested to ensure accurate filing.

- Review all fields for correctness, comparing them against official documents. Verify that the details entered reflect the entity's status and tax-exempt compliance.

- Once all sections are completed and reviewed, save your changes. You can then download, print, or share the completed form as needed.

Start completing your form online today for a seamless tax-exempt certification process.

To obtain a U.S. tax residency certificate, you need to submit a request to the IRS, usually by filling out Form 8948 and providing documentation that proves your residency status. It’s important to ensure all filed tax documents are up to date, as this can influence the approval of your request. Form 6166 will ultimately be issued if the IRS verifies your residency and will serve as your official certificate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.