Loading

Get Gst 524

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst 524 online

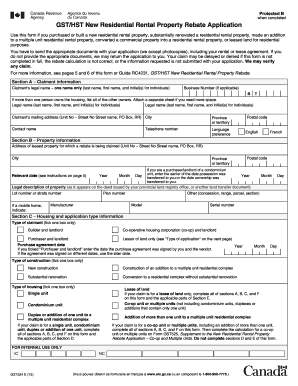

The Gst 524 form is essential for individuals and businesses seeking a rebate on their new residential rental property. By following this comprehensive guide, users can fill out the form accurately and efficiently, ensuring a smooth application process.

Follow the steps to complete the Gst 524 online.

- Click ‘Get Form’ button to obtain the Gst 524 form and open it in the editor.

- In Section A, provide your claimant information, including your legal name, business number (if applicable), mailing address, and contact details. Ensure all fields are filled out accurately to avoid delays in processing.

- Move to Section B and enter the address of the leased property for which you are claiming the rebate. Include relevant dates related to the property, such as the possession or ownership transfer date, presented in the correct year, month, and day format.

- In Section C, indicate your type of claimant by ticking the applicable box. Provide details regarding the construction type and housing type, and include the date of the purchase agreement if you selected 'Purchaser and landlord.'

- Proceed to Section D for rebate calculations based on the type of property and claim you selected. Complete Parts I and II if applicable, meticulously inputting the amounts for GST and HST as required.

- If claiming for Type 9A or Type 9B, move to Section E and provide calculations related to the self-supply of land or the relevant provincial applicable calculations.

- In Section F, certify the accuracy of all shared information by completing the certification statement and signing with your name, date, and any authorized person’s signature as necessary.

- Lastly, in Section G, if you wish to have your refund deposited directly into your bank account, fill out the banking information or attach a voided cheque. After completing the form, ensure you save your changes, download or print the form for your records.

Start filling out your Gst 524 form online today for a seamless application process!

The tax rate for rental property in Canada typically aligns with the federal GST rate, which stands at 5%. However, provincial rates may apply, depending on your location. It’s important to remain informed of potential changes in tax rates that may affect your rental income. Using UsLegalForms can help ensure you stay up-to-date and compliant with tax laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.