Loading

Get Bulletin Mft 004 Application 119 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bulletin Mft 004 Application 119 Form online

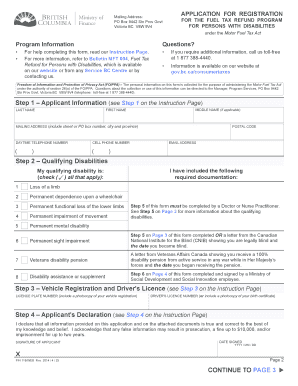

This guide provides a step-by-step approach for successfully completing the Bulletin Mft 004 Application 119 Form online. Whether you are new to such applications or need a refresher, this guide will help you navigate the required fields with confidence.

Follow the steps to complete your application form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal information. This includes your full name, mailing address, and contact information. Ensure that all details are accurate for effective communication.

- Check all qualifying disabilities that apply to you and provide the necessary documentation for each. This step is crucial for confirming eligibility for the program.

- Provide vehicle registration and driver's license information. If you are not the registered owner, include additional documentation as per the instructions.

- Ensure Step 5 is completed by a doctor or nurse practitioner, who will verify your qualifying disability. This must be returned to you for submission.

- If applicable, complete the Release of Information Consent in Step 6 and have it signed by an employee from the Ministry of Social Development and Social Innovation.

- Review the applicant declaration, sign and date it to affirm that all provided information is true and correct.

- Prepare your completed application for submission, ensuring all documentation is included, and send it via your preferred method.

- You can save changes, download, print, or share the form as needed after filling it out.

Complete your Bulletin Mft 004 Application 119 Form online today and take the first step towards accessing the fuel tax refund program.

Eligibility for the carbon tax rebate in BC primarily depends on income level and family circumstances. The government aims to ensure that lower-income households can effectively receive support. To determine your eligibility, review the guidelines available and complete the Bulletin Mft 004 Application 119 Form to apply for this essential rebate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.