Loading

Get Aus Findings Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Aus Findings Form online

The Aus Findings Form is an essential document for capturing underwriting findings for mortgage applications. This guide will help you navigate through each section of the form with detailed instructions, ensuring a smooth online completion process.

Follow the steps to accurately complete the Aus Findings Form online.

- Press the ‘Get Form’ button to access the Aus Findings Form and open it in your preferred editor.

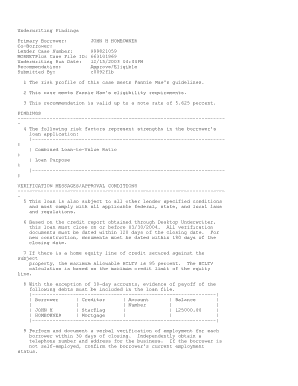

- Start with the primary borrower section by entering the full name of the primary borrower. Ensure that the name matches the documents provided.

- If applicable, fill in the co-borrower section with the information of any additional parties involved in the loan application.

- Enter the lender case number and the MORNETPlus case file ID accurately. These identifiers are crucial for tracking your submission.

- Input the underwriting run date in the specified format. This date indicates when the underwriting analysis was conducted.

- Select the recommendation from the options provided, such as ‘Approve/Eligible’ or other relevant judgments.

- In the findings section, list all identified strengths related to the borrower's loan application, such as the combined loan-to-value ratio and loan purpose.

- Review and complete the verification messages/approval conditions section, ensuring all required documents and dates comply with stipulated guidelines.

- Fill in the observations area, ensuring all information related to the loan's submission and credit scores is detailed accurately.

- Finally, ensure all filled fields are complete, save your changes, and explore options to download, print, or share the Aus Findings Form as needed.

Complete your Aus Findings Form online today for an efficient application process.

For Fannie Mae, the AUS is known as Desktop Underwriter (DU). This system analyzes a borrower's information and assesses their eligibility for mortgage loans. By using the AUS Findings Form, mortgage professionals can provide quicker responses and ensure that loans align with Fannie Mae's guidelines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.