Get 501b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 501b online

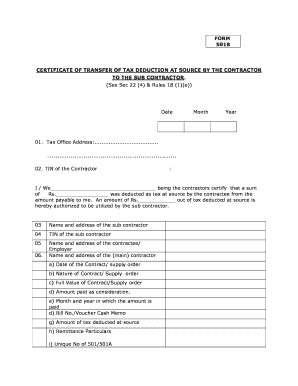

Filling out the 501b form online can streamline the process of certifying tax deductions transferred from contractors to subcontractors. This guide provides clear, step-by-step instructions to ensure that users can complete the form accurately and efficiently.

Follow the steps to complete the 501b form online.

- Press the ‘Get Form’ button to access the form and open it in your browser.

- Enter the date of the transfer in the designated field. Ensure it reflects the correct day, month, and year.

- Fill in the tax office address where the contractor is registered. Include all details as required.

- Provide the Tax Identification Number (TIN) of the contractor in the specified section.

- Certify the amount of tax deducted at source by writing the precise sum in the appropriate field.

- List the name and address of the subcontractor to whom the tax deduction is being transferred.

- Enter the TIN of the subcontractor in the corresponding field.

- Complete the name and address section for the contractee or employer, ensuring accuracy.

- Provide details about the contract, including the date, nature, and full value of the contract or supply order.

- Indicate the amount paid as consideration, the month and year in which payment occurred, bill number, and the amount of tax deducted at source.

- Fill in the remittance particulars and the unique number associated with the 501 or 501A forms.

- For subcontractor details, include the date of the subcontract, full value, amount being paid, and the tax deducted transferred to the subcontractor.

- Review all entries for accuracy and completeness before moving to the next step.

- Once you have confirmed that the information is correct, save changes, download the completed form, or choose to print or share it as needed.

Complete your 501b form online today for efficient tax deduction management.

Obtaining '501' status means that your organization qualifies as a tax-exempt nonprofit under the Internal Revenue Code. This status enables you to operate without federal income tax and allows donors to make contributions that may be tax-deductible. Understanding the implications of getting 501 status, particularly regarding 501b, can help ensure your organization complies with IRS regulations while maximizing its impact.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.