Loading

Get Irs Submission Identification Number

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Submission Identification Number online

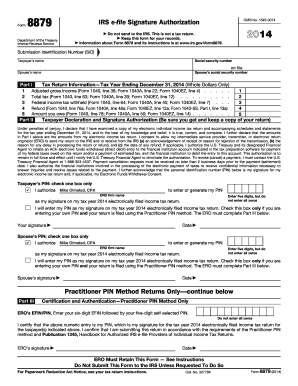

This guide provides clear instructions for users on completing the IRS Submission Identification Number as part of Form 8879, the IRS e-file Signature Authorization. This form is essential for electronically filing your individual income tax return and ensuring compliance.

Follow the steps to complete your IRS Submission Identification Number form online.

- Press the ‘Get Form’ button to access the IRS submission identification number form online and open it for editing.

- Fill in the taxpayer’s name and social security number at the top of the form. Ensure this information is accurate to avoid delays in processing your return.

- Next, provide the spouse's information, including their name and social security number, if applicable. This is crucial for joint filings.

- Move on to Part I and enter the tax return information for the tax year ending December 31, 2014. This includes your adjusted gross income, total tax, federal income tax withheld, refund amount, and any balance owed. Make sure to use whole dollar amounts only.

- In Part II, provide the necessary declaration and signature authorization. Confirm the information on your tax return is accurate. Authorize the electronic return originator (ERO) to enter or generate your personal identification number (PIN).

- Enter your PIN, ensuring it is five digits long and not all zeros. Indicate if you or the ERO will enter this PIN on your tax return. Sign and date the form to confirm your consent for e-filing.

- If applicable, provide the spouse’s PIN and similar authorizations. Ensure it is also five digits and not all zeros. Confirm the information with your signature.

- If filing with the Practitioner PIN method, complete Part III, which involves the ERO entering their Electronic Filing Identification Number (EFIN) and personal PIN.

- Once all fields are completed accurately, save changes and download or print a copy of the Form 8879 for your records. You can share the finalized document with the ERO or retain it as needed.

Complete your IRS Submission Identification Number form online to ensure prompt processing of your tax return.

A submission ID number is a unique identifier linked to your specific tax submissions to the IRS. This number helps both you and the IRS track and manage the documents effectively. By having an IRS Submission Identification Number, taxpayers can easily refer to their filing status and expedite resolution of any potential issues.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.