Get Collateral Assignment Of Life Insurance Policy - Mutual Of Omaha

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

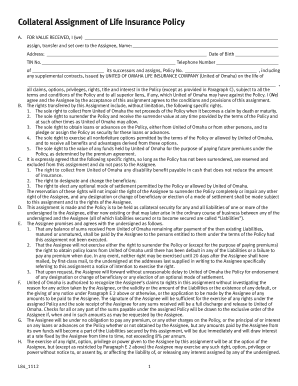

How to fill out the Collateral Assignment Of Life Insurance Policy - Mutual Of Omaha online

Filling out the Collateral Assignment Of Life Insurance Policy - Mutual Of Omaha online can be straightforward with the right guidance. This guide will provide you with detailed, step-by-step instructions to complete the form efficiently.

Follow the steps to complete your form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your name in the designated field. This identifies you as the assignor of the policy.

- In the 'Assign To' section, fill in the name of the assignee. This is the person or entity to whom you are assigning the policy.

- Provide the address of the assignee. Ensure that this information is accurate to avoid any issues in future communications.

- Enter the date of birth of the assignee to confirm their identity.

- Fill in the tax identification number (TIN) of the assignee. This is important for tax purposes.

- Enter the telephone number of the assignee for further communication.

- Specify the policy number in the designated field, ensuring it matches the life insurance policy you are assigning.

- Review all filled sections to ensure accuracy of information.

- After completing the form, save your changes. You may also choose to download, print, or share the completed document.

Complete your Collateral Assignment Of Life Insurance Policy online today for a seamless experience.

A collateral assignment of life insurance refers to a legal arrangement where a policyholder designates a lender or third party as a beneficiary to the policy’s death benefit. This arrangement secures a debt while allowing the policyholder to maintain ownership rights. By using a collateral assignment of life insurance policy - Mutual Of Omaha, individuals can leverage their life insurance for financial flexibility.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.