Loading

Get Vat 71

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat 71 online

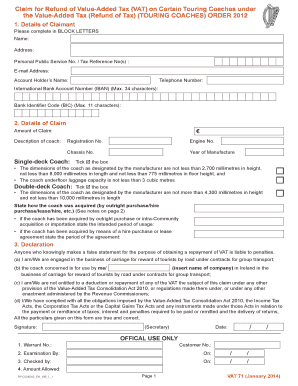

Filling out the Vat 71 form online may seem daunting, but with our comprehensive guide, you can navigate each section confidently. This document helps claim refunds for value-added tax on certain touring coaches, ensuring you provide all necessary information accurately.

Follow the steps to complete your Vat 71 form online.

- Click ‘Get Form’ button to obtain the Vat 71 form and open it in your preferred editor.

- In section one, enter your personal details accurately. Use block letters for your name, address, and contact details, including your email and telephone number.

- Provide your Personal Public Service Number or Tax Reference Numbers as needed, along with your bank details, like IBAN and BIC.

- Move to section two and clearly state the amount of VAT you are claiming, describing the coach and providing its registration, engine number, chassis number, and year of manufacture.

- Indicate whether your coach is a single-deck or double-deck by ticking the appropriate box, ensuring you meet the specified requirements for dimensions and storage capacity.

- Describe how you acquired the coach, specifying whether it was through outright purchase, hire purchase, lease, or hire. Include the intended period of usage for acquisitions.

- In section three, read the declaration carefully. Acknowledge your engagement in the relevant business and confirm that all details provided are accurate by signing the form.

- Before submission, ensure all supporting documentation is completed and attached, such as invoices and agreements as specified in the form.

- Once everything is completed, save your changes, and download, print, or share the form as necessary.

Complete your Vat 71 form online today to ensure your VAT refund claim is processed efficiently.

VAT is filed by completing the necessary VAT forms with accurate financial information. Platforms like Vat 71 simplify this process by providing guided instructions for each step. By ensuring your data is correct and timely, you can efficiently file your VAT return and avoid penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.