Loading

Get 1040ez

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1040ez online

Filing your tax return can be a straightforward process if you understand the steps involved in completing the 1040ez form. This guide will walk you through each section of the form, ensuring a smooth online filing experience.

Follow the steps to complete your 1040ez online efficiently.

- Click ‘Get Form’ button to access the 1040ez and open it in your chosen online editor.

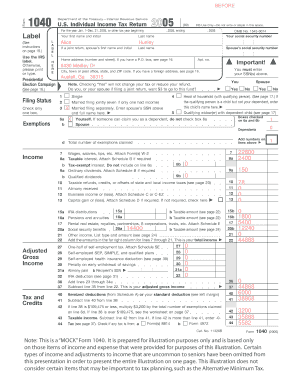

- Begin by entering your personal information at the top of the form, including your first name, last name, and social security number. If filing jointly, include your partner's details.

- In the filing status section, select the appropriate status by checking the corresponding box for your situation—whether it’s single, married filing jointly, or head of household.

- Complete the exemptions section by indicating the number of exemptions you are claiming. This may include yourself, your partner, and any dependents.

- Proceed to the income section, where you will need to list all sources of income, including wages, salaries, and additional earnings. Be sure to attach any required schedules if necessary.

- Calculate your total income by adding all amounts listed. This information will feed into determining your adjusted gross income.

- Report adjustments to income and calculate your final adjusted gross income, which will be essential for determining your tax liability.

- Select your standard deduction based on your filing status or itemized deductions if applicable.

- After calculating your taxable income, review the tax computation section to find out your tax liability based on income brackets.

- Complete any additional required fields, including any applicable credits or additional taxes.

- Finally, review all the entries for accuracy. You can then save your changes, download, print, or share the completed form as needed.

Start filling out your 1040ez online today to ensure a timely submission.

To file your tax return step by step, begin by collecting your income statements and identifying your deductions. Use the 1040ez form if you meet the criteria for a straightforward filing process. Follow the prompts on your chosen tax platform, such as US Legal Forms, to ensure you accurately capture all necessary information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.