Loading

Get Co M-1 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO M-1 online

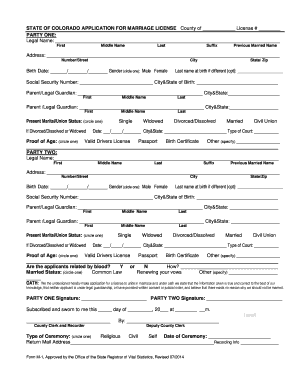

Completing the CO M-1 application for a marriage license online can be a straightforward process with the right guidance. This guide provides clear, step-by-step instructions to help users fill out the form accurately and efficiently.

Follow the steps to complete your application successfully.

- Press the ‘Get Form’ button to access the application form and open it in your preferred online editor.

- Enter the legal name of Party One, including first name, middle name, last name, and suffix. If applicable, include the previous married name.

- Provide the complete address of Party One, detailing the street number, city, state, and zip code.

- Fill in the birth date of Party One in the format MM/DD/YYYY and circle the appropriate gender.

- If applicable, indicate the last name at birth for Party One, followed by the social security number and the city and state of birth.

- List the names of the parent or legal guardian of Party One, along with their city and state of residence.

- Indicate the present marital or union status of Party One by circling the correct option: Single, Married, Divorced/Dissolved, or Widowed.

- If applicable, provide the date of divorce/dissolution or widowhood for Party One, along with city, state, and type of court.

- Circle the type of proof of age provided for Party One, such as a valid driver's license, passport, or birth certificate.

- Repeat steps 2-9 for Party Two, ensuring all information is filled out accurately.

- Answer if the applicants are related by blood and provide any additional details if necessary.

- Circle the married status of both parties and specify the type of ceremony planned.

- Both parties must sign the form to affirm the truthfulness of the information provided. Please also ensure the form is subscribed and sworn by a county clerk.

- Finally, save the changes to the form, and choose to download, print, or share it as needed.

Complete your marriage license application online today!

The M-1 adjustment on a tax return corrects discrepancies between financial reports and taxable income. Adjustments may include items like depreciation differences, tax-exempt income, and other pertinent factors that affect the tax calculation. These adjustments can be crucial for achieving accuracy in your tax filings. With USLegalForms, you can ensure your M-1 adjustments are made correctly and effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.