Get W 9 Form Ga

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W 9 Form Ga online

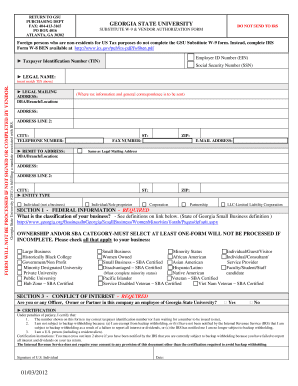

The W 9 Form Ga is an essential document for individuals and vendors providing services in the United States, used to request taxpayer identification information. This guide will help you complete the form accurately and efficiently online, ensuring that all necessary information is provided for tax purposes.

Follow the steps to complete the W 9 Form Ga online

- Press the ‘Get Form’ button to access the W 9 Form Ga and open it in your preferred editing tool.

- Enter your legal name as it appears in your Social Security records in the legal name field.

- Provide your taxpayer identification number (TIN), which may be your Social Security number (SSN) or Employer Identification Number (EIN). Make sure it matches the name provided.

- Fill out your legal mailing address, ensuring that it reflects where tax information and correspondence should be sent.

- Indicate your entity type by checking the appropriate box: Individual, Corporation, Partnership, LLC, or another classification relevant to your business.

- Complete Section 1 with your federal information, selecting at least one ownership or SBA category that accurately represents your business.

- In Section 3, answer the conflict of interest questions regarding employment with Georgia State University. Choose 'Yes' or 'No' for both questions.

- Review the certification statements, ensuring you understand the implications of each item stated. If applicable, cross out item 2 if you are subject to backup withholding.

- Sign and date the form to certify the accuracy of the information provided.

- Finally, save the changes made to the form. You can download, print, or share the completed document as needed.

Complete your W 9 Form Ga online today for accurate and efficient processing.

The W-9 Form GA is used to provide your taxpayer identification information to parties who need to report certain types of income to the IRS. You may need to fill out this form if you're an independent contractor, freelancer, or a business owner. By submitting the W-9, you help ensure accurate tax reporting, which is essential for compliance. Utilizing platforms like USLegalForms simplifies the process, allowing you to easily complete and manage your W-9 Form GA online.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.