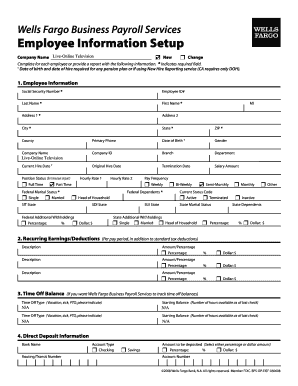

Get Wells Fargo Business Payroll Services Employee Information Setup Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wells Fargo Business Payroll Services Employee Information Setup Form online

Filling out the Wells Fargo Business Payroll Services Employee Information Setup Form is a crucial step for businesses to set up employee information correctly. This guide will help you understand each section of the form and provide clear instructions for completing it online.

Follow the steps to complete the form efficiently.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- In the 'Employee Information' section, enter the employee's Social Security Number, Employee ID#, last name, first name, and address. Fields marked with '*' are required and must be filled out.

- Provide the city, state, ZIP code, and county of the employee. Also, include the primary phone number and the employee's date of birth and date of hire, especially if they will be part of a pension plan.

- Specify the employment details, including the company name, company ID, branch, department, original hire date, termination date (if applicable), and salary amount.

- Indicate the current hire date and position status. Select whether the employee is full-time or part-time and enter the applicable hourly rates if needed.

- Fill out the federal marital status and federal dependents sections, and provide information for federal withholdings based on salary frequency selected.

- Complete the recurring earnings/deductions section by detailing any additional deductions or earnings per pay period. Enter the description and amount or percentage for each entry.

- If you want to track time off balances, fill in the time off section by indicating the type of time off and the starting balance available.

- In the direct deposit information section, specify the bank name, routing/transit number, account type, and whether the deposit should be a percentage or a dollar amount.

- Review all the information for accuracy. Once confirmed, you can save your changes, download, print, or share the completed form.

Complete your Wells Fargo Business Payroll Services Employee Information Setup Form online today!

While it is possible to use Excel for payroll, it may become complicated as your business grows. Maintaining accuracy and compliance with tax regulations can be challenging. Instead, consider using the Wells Fargo Business Payroll Services Employee Information Setup Form for a structured approach. This form guides you in managing payroll more effectively and ensures accuracy in your records.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.