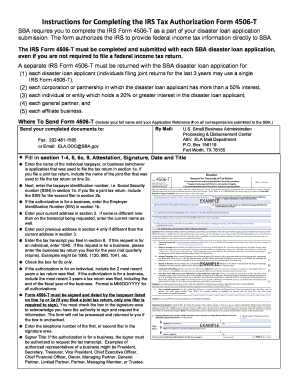

Get Instructions For Completing The Irs Tax Authorization Form 4506-t - Sba

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Instructions For Completing The IRS Tax Authorization Form 4506-T - Sba online

How to fill out and sign Instructions For Completing The IRS Tax Authorization Form 4506-T - Sba online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Discover all the advantages of submitting and finalizing documents online. With our platform, submitting Instructions For Completing The IRS Tax Authorization Form 4506-T - Sba takes just a few moments.

We facilitate this by providing you access to our feature-rich editor capable of modifying the original text of a document, adding unique fields, and e-signing.

Send your newly completed Instructions For Completing The IRS Tax Authorization Form 4506-T - Sba electronically as soon as you finish it. Your data is well-guarded, as we adhere to the most current security standards. Join millions of satisfied users who are already completing legal documents from the comfort of their homes.

- Select the template you require from our assortment of legal form samples.

- Press the Get form button to open it and begin editing.

- Complete all the required fields (these are highlighted in yellow).

- The Signature Wizard will allow you to insert your electronic signature right after you have filled in your information.

- Add the date.

- Review the entire form to make sure you have filled in all the information correctly and no amendments are necessary.

- Click Done and download the completed form to your device.

How to Modify Acquire Guidance For Finalizing The IRS Tax Authorization Form 4506-T - Sba

Tailor forms digitally with ease.

Streamline your documentation preparation and adjust it to your preferences within moments. Complete and endorse Acquire Guidance For Finalizing The IRS Tax Authorization Form 4506-T - Sba with a detailed yet user-friendly online editor.

Creating documents can always be challenging, especially when you handle it occasionally. It requires you to meticulously follow all protocols and accurately complete all sections with complete and precise information. However, it frequently happens that you need to modify the document or include additional fields to complete. If you wish to enhance Acquire Guidance For Finalizing The IRS Tax Authorization Form 4506-T - Sba before submitting it, the optimal approach is by utilizing our extensive yet simple online editing tools.

This thorough PDF editing solution enables you to swiftly and effortlessly fill out legal forms from any device with internet access, make essential adjustments to the document, and add extra fillable fields. The platform allows you to specify a certain area for each type of data, such as Name, Signature, Currency, and SSN, among others. You can designate some fields as mandatory or conditional and decide who should complete each section by assigning them to a specific recipient.

Our editor is a versatile multi-functional online tool that can assist you in optimizing Acquire Guidance For Finalizing The IRS Tax Authorization Form 4506-T - Sba and other documents tailored to your specifications. Decrease document preparation and submission time while ensuring your paperwork appears flawless without complications.

- Access the necessary file from the directory.

- Complete the fields with Text and use Check and Cross tools for the tickboxes.

- Employ the right-hand panel to modify the document by adding new fillable sections.

- Choose the fields based on the type of information you wish to collect.

- Designate these fields as mandatory, optional, or conditional and arrange their sequence.

- Allocate each field to a specific participant using the Add Signer feature.

- Verify that all necessary changes have been made and click Done.

The code 570 on a tax transcript signifies that the IRS has identified a pending issue with your return. This could relate to audits or additional information needed before processing. For clarity on these matters, refer to the Instructions For Completing The IRS Tax Authorization Form 4506-T - Sba to ensure your transcript is handled appropriately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.