Get Instructions For Completing The Irs Tax Authorization Form 4506-t - Sba

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For Completing The IRS Tax Authorization Form 4506-T - Sba online

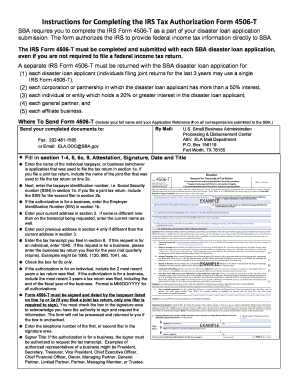

The IRS Tax Authorization Form 4506-T is a crucial document for individuals and businesses applying for SBA disaster loans. This guide provides step-by-step instructions for accurately completing the form online, ensuring you grant the IRS permission to share your federal income tax information with the SBA.

Follow the steps to accurately complete the form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- In section 1a, enter the full name of the individual taxpayer or business used to file the tax return. If you are filing a joint return, include the name of the second filer in section 2a.

- In section 1b, enter the taxpayer identification number, which is your Social Security number (SSN). If applicable, include the SSN for the second filer in section 2b. For businesses, enter the Employer Identification Number (EIN).

- Enter your current address in section 3. If your name has changed since the tax return, include your current name as well.

- If your previous address is different from your current address, provide it in section 4.

- In section 6, indicate the type of tax transcript requested. For individuals, enter '1040'; for businesses, use the appropriate form for the business tax return filed, such as '1065' or '1120'.

- Check the box for 6c only.

- For individuals, provide the two most recent years a tax return was filed. For businesses, include the most recent three years, with the fiscal year end date formatted as MM/DD/YYYY.

- Sign and date the form in the designated area. Only one filer is required to sign if it's a joint return, and ensure the authorization box is checked.

- Include the telephone number of one of the filers in the signature area.

- If the authorization is for a business, list the title of the signer in the designated field. Make sure the signer is authorized to request the tax transcript.

- After completing the form, save your changes. You can download, print, or share the form as needed.

Complete your IRS Form 4506-T online today and ensure a smooth SBA disaster loan application process.

The code 570 on a tax transcript signifies that the IRS has identified a pending issue with your return. This could relate to audits or additional information needed before processing. For clarity on these matters, refer to the Instructions For Completing The IRS Tax Authorization Form 4506-T - Sba to ensure your transcript is handled appropriately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.