Loading

Get Sa302 Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sa302 Template online

The Sa302 Template is an essential document for individuals completing self-assessment tax returns in the UK. This guide provides a clear and structured approach to help users fill out this template online efficiently.

Follow the steps to complete the Sa302 Template online

- Press the ‘Get Form’ button to access the Sa302 Template and open the form in an online editor.

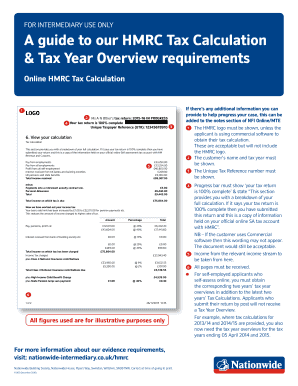

- Fill in your personal details. Include your Unique Taxpayer Reference (UTR), full name, and the relevant tax year. Ensure all information is accurate to avoid any processing delays.

- Include your income details. Report all sources of income, such as salary, self-employment profits, interest from banks, and pensions.

- Subtract any allowances. This may include your personal allowance and any contributions to pensions.

- Calculate the total income on which tax is due. Be mindful of the thresholds for different tax rates to correctly assess your liability.

- Complete the section detailing how the income tax is calculated, including rates and any deductions.

- Review your entries for accuracy before finalizing. Ensure that all required fields are filled and double-check figures.

- Once satisfied, save your changes and choose to download, print, or share the completed Sa302 Template as needed.

Begin filling out your Sa302 Template online today.

The SA302 calculation refers to the process of determining your total taxable income based on your earnings, deductions, and any applicable reliefs. HMRC performs this calculation and presents the results on your SA302 Template. Understanding this calculation can help you make informed financial decisions and plan for future tax liabilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.