Loading

Get Sf 1099

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sf 1099 online

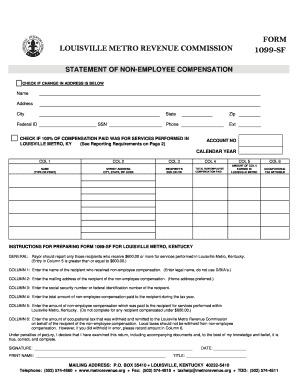

Filling out the Sf 1099 is an essential step for reporting non-employee compensation. This guide offers clear and supportive instructions for completing the form online, helping you navigate each component with ease.

Follow the steps to successfully complete the Sf 1099 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- In the 'Name' field, enter the legal name of the recipient who received the non-employee compensation. Avoid using any 'doing business as' (D/B/A) names.

- Fill in the 'Address' section with the recipient's mailing address, preferably their home address.

- Input the recipient's social security number or federal identification number in the designated field.

- In the 'Total non-employee compensation paid' field, record the full amount of non-employee compensation paid to the recipient during the tax year.

- For the 'Amount of earned in Louisville Metro' field, indicate the compensation amount paid for services performed within Louisville Metro, Kentucky. Do not complete this if the recipient was compensated under $600.00.

- Enter the amount of occupational tax withheld in the corresponding field if applicable. If it was withheld in error, make sure to record that amount.

- Review all entries for accuracy before providing your signature, printed name, date, and title in the signature section.

- Once completed, save changes, download the form, print it, or share it as needed.

Complete your documents online today to ensure timely compliance with reporting requirements.

O imposto 1099 é associado à declaração de rendimentos distintos que não estão relacionados a salários diretos. Ele assegura que a IRS tenha conhecimento de todos os rendimentos recebidos por freelancers e prestadores de serviço. Com a utilização do formulário Sf 1099, você pode relatar esses rendimentos de forma adequada e evitar problemas futuros. Para simplicidade, considere usar a UsLegalForms para auxiliar na gestão desse imposto.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.