Loading

Get Tabc Form C 215

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tabc Form C 215 online

This guide provides a comprehensive overview for users on how to complete the Tabc Form C 215 online. Whether you are a seasoned professional or new to digital document management, these step-by-step instructions will make the process clear and manageable.

Follow the steps to successfully complete the Tabc Form C 215 online.

- Press the ‘Get Form’ button to access the Tabc Form C 215 online and open it in your preferred editing tool.

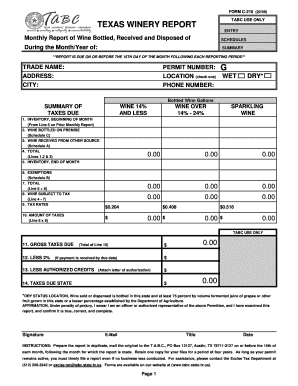

- Fill out the fields in the 'Trade Name,' 'Address,' 'City,' 'Permit Number,' and 'Phone Number' sections. Ensure that these details accurately reflect your business information.

- Indicate whether your location is 'Wet' or 'Dry' by checking the appropriate box.

- Complete the 'Bottled Wine Gallons' summary by entering the inventory details. Start with the 'Beginning Inventory,' then enter the 'Wine Bottled on Premise' and 'Wine Received from Other Source’.

- Calculate the 'Total' by adding Lines 1, 2, and 3 together. This total reflects your wine transactions for the month.

- Record the 'Ending Inventory' and any applicable 'Exemptions.' These figures will be used to determine your taxable wine.

- Determine the 'Wine Subject to Tax' by subtracting the total exemptions from the total gallons calculated earlier.

- Fill in the 'Tax Rates' and calculate the 'Amount of Taxes' by multiplying the 'Wine Subject to Tax' by the applicable tax rate.

- Complete the remaining fields for 'Gross Taxes Due,' 'Less 2%,' and 'Less Authorized Credits' if applicable.

- Finalize the report by signing in the affirmation section, entering your title, email, and the date of submission.

- After reviewing all information for accuracy, save your changes. You can then download, print, or share the completed form as needed.

Complete your Tabc Form C 215 online today to ensure timely reporting and compliance.

Typically, it takes approximately 1 to 2 weeks to receive a Texas sales tax certificate after submitting your application. Once you complete the required forms, the Texas Comptroller processes them. Keep in mind that ensuring all documentation is correct can expedite this process. For those using TABC Form C 215 in their transactions, having this certificate readily available simplifies compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.