Loading

Get Forms A771 And A771a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Forms A771 And A771a online

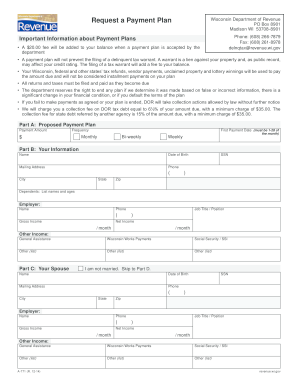

This guide provides step-by-step instructions for filling out Forms A771 and A771a online. By following these instructions, users can ensure they complete the forms correctly and efficiently.

Follow the steps to complete your forms accurately.

- Click the ‘Get Form’ button to acquire the forms and open them in the designated editor.

- Begin with Part A, Proposed Payment Plan. Enter the payment amount you are proposing and select the frequency of the payments (monthly, bi-weekly, or weekly). Specify the first payment date, ensuring it falls between the 1st and 28th of the month.

- Proceed to Part B, Your Information. Fill in your name, date of birth, mailing address, social security number, and phone number. Include the city, state, and zip code. List your dependents, including their names and ages. Provide your employer's name, phone number, job title, gross income, and net income.

- If applicable, complete Part C, Your Spouse. If you are not married, proceed to Part D. Input your spouse's details, including their name, date of birth, mailing address, social security number, phone number, employer's name, and income details.

- In Part D, Banks and Other Financial Institutions, list all financial accounts and their balances. This includes checking, savings, retirement accounts, and any others you may have.

- For Part E, detail your motor vehicles, boats, motorcycles, and other similar assets. Provide the year, make, model, fair market value, and lien holder for each vehicle. Include the balance owed.

- In Part F, Real Estate, list all properties you own. State the location, fair market value, mortgage holder, and balance due for each property.

- Next, in Part G, Expenses, document your monthly payments for various expenses, including mortgage or rent, vehicle payments, utilities, food, insurance, and entertainment. Calculate the total monthly expenses.

- Finally, review Part H, Signature. Ensure you have read and understood the payment plan terms. Sign and date the form. If applicable, have your spouse sign and date as well.

- Once all sections are completed, save your changes, and download a copy for your records. You can also print the forms or share them as necessary.

Complete your Forms A771 And A771a online today!

To find out if you owe taxes in Wisconsin, you can check your municipal or county tax records online or contact your local tax authority directly. Additionally, using Forms A771 and A771a can help clarify your tax situation and any outstanding debts. Addressing this proactively will help you stay informed and avoid any surprises. Remember, knowledge is power when it comes to managing your tax responsibilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.