Loading

Get Form 5471 Schedule M

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5471 Schedule M online

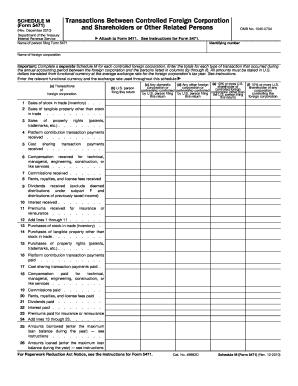

Form 5471 Schedule M is essential for reporting transactions between controlled foreign corporations and their shareholders or related persons. This guide will provide you with a clear, step-by-step approach to completing this form online, ensuring you meet tax requirements effectively.

Follow the steps to complete Form 5471 Schedule M online

- Use the ‘Get Form’ button to access the form and open it in your desired editor.

- Enter your name in the designated field for the person filing Form 5471.

- Fill in the identifying number, which is crucial for tax identification purposes.

- Provide the name of the foreign corporation associated with the transactions.

- Complete a separate Schedule M for each controlled foreign corporation as required.

- In section (a), report the specific transactions of the foreign corporation, including sales, purchases, and other relevant financial activities.

- For columns (b) through (f), enter the total amounts for each type of transaction, ensuring all amounts are in U.S. dollars, translated from functional currency at the average exchange rate applicable to the foreign corporation’s tax year.

- Document the relevant functional currency used, alongside the exchange rate, in the specified fields.

- Continue filling in the various transactions, including sales of inventory, purchases of property, rents, dividends, interest received and paid, as outlined.

- Once all fields are completed and double-checked for accuracy, you can proceed to save changes, download, print, or share the form as needed.

Complete your tax documents online today for a seamless filing experience!

Form 5471 Schedule M is required if you have certain interests in foreign corporations. If you are a US person who is an officer, director, or shareholder in a foreign corporation, you must file this form to comply with U.S. tax laws. Neglecting to file can lead to severe penalties. Therefore, understanding your filing obligations is essential.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.