Loading

Get Form 941 Worksheet 1 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 941 Worksheet 1 Fillable online

This guide provides a comprehensive overview of how to accurately complete the Form 941 Worksheet 1 Fillable online. By following these steps, users can ensure that their information is correctly submitted for processing.

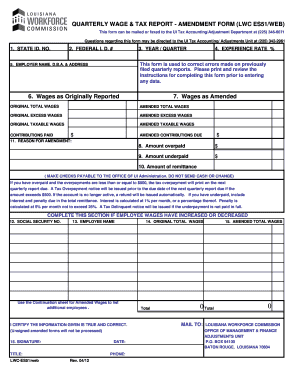

Follow the steps to successfully complete the Form 941 Worksheet 1 Fillable online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your State ID number in the designated field.

- Enter your Federal ID number accurately to ensure proper identification.

- Specify the year and quarter for which you are filing the report.

- Input your experience rate percentage in the corresponding section.

- Provide your employer name, doing business as (D.B.A), and address clearly.

- Fill in the original wages as reported previously in the 'Wages as Originally Reported' section.

- Next, indicate the amended wages in the 'Wages as Amended' section, ensuring accuracy.

- Record original and amended totals for wages, excess wages, and taxable wages as required.

- Detail any contributions paid and ensure these figures reflect the correct amounts.

- Specify the reason for the amendment in the dedicated field.

- Indicate the amount overpaid or underpaid as applicable.

- Calculate the amount of remittance required and include any interest or penalties if underpaid.

- If applicable, complete the section for employee wages that have increased or decreased, listing the necessary details.

- Certify the information provided by signing, entering the date, and including your title.

- Finally, save your changes, and choose to download, print, or share the form as needed.

Complete your document submissions online to streamline your filing process.

941 typically means the Employer's Quarterly Federal Tax Return, which is a crucial document for businesses. It helps track payroll taxes over each quarter, ensuring compliance with federal tax laws. For convenience, many businesses use the Form 941 Worksheet 1 Fillable to manage this requirement smoothly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.