Get Sfusd Senior Citizen Exemption Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sfusd Senior Citizen Exemption Application Form online

This guide provides clear instructions for completing the Sfusd Senior Citizen Exemption Application Form online, ensuring that all necessary steps are understood. By following these steps, users can easily navigate the form and submit their exemption applications with confidence.

Follow the steps to complete your exemption application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

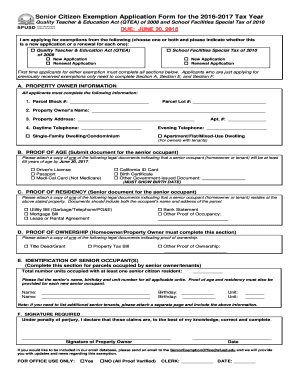

- Indicate whether this is a new application or a renewal for the Quality Teacher & Education Act (QTEA) of 2008 and/or the School Facilities Special Tax of 2010 by checking the appropriate box.

- Complete Section A by providing your parcel block number and lot number, your name, property address, and contact telephone numbers.

- In Section B, attach a copy of a legal document as proof of age for the senior occupant. Acceptable documents include a driver's license, passport, or birth certificate.

- In Section C, provide proof of residency by attaching a document that includes both the senior occupant's name and the property address, such as a utility bill or mortgage bill.

- In Section D, submit proof of ownership by including a document such as a title deed or property tax bill.

- Complete Section E if applicable, listing the name, birthday, and unit number of any senior occupants. Attach additional pages if necessary.

- In Section F, sign the form and date it to declare that the information provided is correct to the best of your knowledge.

- Save your changes, then download, print, or share the completed form as needed.

Be sure to complete your application online and submit all required documents before the deadline to ensure your exemption eligibility.

The senior citizen assessment freeze exemption in Cook County helps eligible seniors by freezing the assessed value of their property for tax purposes. This means that even if property values increase, their tax liability will remain constant. Seniors can access this exemption by filling out the Sfusd Senior Citizen Exemption Application Form to ensure they receive the benefits they deserve.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.