Loading

Get Sars Logbook Download

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sars Logbook Download online

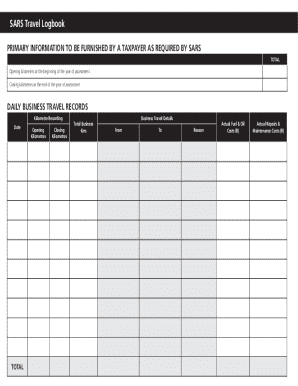

The SARS Travel Logbook is an essential tool for individuals to record and claim deductions for business travel. Properly filling out this logbook is crucial for accurately calculating your travel deductions.

Follow the steps to fill out your travel logbook.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the date of your travel in the appropriate section labeled 'Date'. This is where you'll log each travel instance.

- Input your 'Opening Kilometres', which refers to your vehicle's odometer reading at the start of the assessment year. This reading is taken on 1 March.

- After completing your travel for the day, record the 'Closing Kilometres', which is your vehicle's odometer reading at the end of the day.

- Calculate the 'Total Business Kms' by subtracting the 'Opening Kilometres' from the 'Closing Kilometres'. This gives you the total distance traveled for business on that date.

- Fill out the 'Business Travel Details' section. Enter the 'From' and 'To' locations of your travel, along with the reason for the travel.

- Enter the 'Actual Fuel & Oil Costs (R)' and 'Actual Repairs & Maintenance Costs (R)' incurred during your travel. These figures should reflect your actual expenses.

- Once you have filled out all the necessary sections for each travel record, review your entries for accuracy.

- When you are satisfied with your entries, save your changes, and then choose to download or print the completed form for your records.

Start completing your SARS Travel Logbook online today for accurate travel expense claims.

A vehicle log book in South Africa tracks business-related journeys for tax purposes. It documents the distance and purpose of each trip, helping you justify travel claims. Accurate logbooks are crucial for meeting IRS requirements. Utilizing the Sars Logbook Download feature can assist you in maintaining precise records effortlessly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.