Get Nttc Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nttc Form online

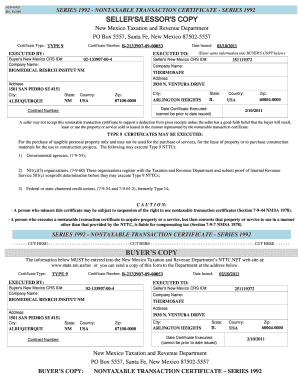

The Nttc Form, or nontaxable transaction certificate, is an essential document for certain purchasers in New Mexico. This guide provides clear and user-friendly steps to help you complete the Nttc Form online with confidence.

Follow the steps to fill out the Nttc Form smoothly.

- Click ‘Get Form’ button to obtain the form and open it in the document editor.

- Begin by filling out the certificate type. Enter 'TYPE 9' in the designated field to identify the purpose of the certificate.

- Next, fill in the certificate number (e.g., B-2133907-09-00053) in the provided space. This number is crucial for tracking your transaction.

- Indicate the buyer's New Mexico CRS ID number. This is a unique identifier for tax purposes.

- Enter the company name of the buyer accurately. Ensure that it matches the legal name on file with tax authorities.

- Provide the address details including street address, city, state, zip code, and country for the buyer.

- Record the seller’s New Mexico CRS ID number in the appropriate section.

- Fill out the seller’s company name and address similar to how you entered the buyer’s information.

- State the date the certificate is executed. Remember, this date cannot be prior to the date it was issued.

- Finally, review all entered information for accuracy. After verifying, you can save your changes, download, print, or share the completed form.

Complete your documents online with ease and ensure your compliance!

To earn a gifted endorsement in New Mexico, you'll need to complete specific coursework focused on gifted education. This typically includes graduate-level courses that address instruction for gifted learners. After finishing the coursework, apply for the endorsement through the New Mexico Public Education Department. They will provide direction on submitting your application and any necessary forms, ensuring you're correctly certified to teach gifted students.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.