Get 1 D 1 Open Space Agricultural Valuation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1 D 1 Open Space Agricultural Valuation online

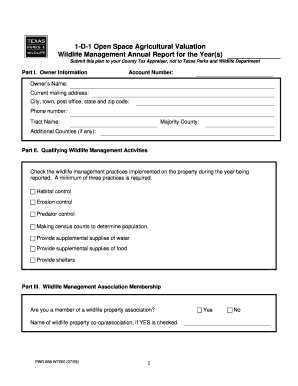

Completing the 1 D 1 Open Space Agricultural Valuation form is an essential step for property owners engaged in wildlife management. This guide provides clear, step-by-step instructions to help you accurately fill out the form online, ensuring compliance with local requirements and maximizing your potential benefits.

Follow the steps to successfully complete the 1 D 1 Open Space Agricultural Valuation online.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Begin with Part I, which requires your owner information including account number, owner’s name, mailing address, city, state, zip code, phone number, tract name, and any majority or additional counties.

- Move on to Part II where you must check a minimum of three wildlife management practices that you have implemented on your property during the reporting year.

- In Part III, indicate whether you are a member of a wildlife property association. If 'Yes', provide the name of the association.

- Part IV entails detailing the specific wildlife management activities you have performed. Check the relevant actions under each subsection like habitat control, erosion control, predator control, supplemental water, supplemental food, and shelter.

- For each activity in Part IV, provide additional information as required, such as acres managed, methods utilized, and specific species involved.

- Complete the census data by filling in any required counts and supporting observations as described in Part VII.

- Finally, attach copies of any supporting documentation such as receipts or maps in Part V and ensure that you include your signature and date to certify the information's accuracy.

- Once all sections are completed, you can save your changes, download the form, print it, or share it as necessary.

Start completing your 1 D 1 Open Space Agricultural Valuation form online today to ensure proper filing and management of your wildlife activities.

In Texas, a wildlife exemption is available for landowners who actively manage their property to promote wildlife conservation practices. This can include activities such as habitat management, population monitoring, and the establishment of wildlife corridors. By applying the principles of the 1 D 1 Open Space Agricultural Valuation, landowners can benefit from tax savings while contributing positively to the environment.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.